How to Create a Gym Budget (15 Easy-ish Steps + Examples)

Learn how to create a gym budget so that you can open a gym, run a gym, and grow a gym while maximizing gym revenue and profitability. Creating a budget is a crucial step for any fitness business, especially for gym owners who want to effectively manage their finances and ensure the success and sustainability of their operations. In this comprehensive guide to creating a budget for a commercial gym or fitness studio, we will dive deep into the process of creating a gym budget, exploring its importance, benefits, and step-by-step instructions to help you develop a robust financial plan for your fitness business.

Learn how to create a gym budget that fits your financial goals and helps you achieve your fitness business objectives, whether you are starting a new fitness business or professionalizing and growing an existing gym business.

Example Gym Budget

Assuming a $1 million annual revenue, here’s an example budget for a gym. It’s important to note that exact figures may vary greatly depending on factors such as geographic location, size of the gym, number of employees, and so on.

- Revenue – $1,000,000

- Expenses

- Rent (10% of revenue) – $100,000

- Payroll and Employee Benefits (30% of revenue) – $300,000

- Equipment purchase and maintenance (5% of revenue) – $50,000

- Utilities and Maintenance (8% of revenue) – $80,000

- Insurance (2% of revenue) – $20,000

- Marketing and Advertising (3% of revenue) – $30,000

- Professional Services (legal, accounting, etc.) (3% of revenue) – $30,000

- Software (gym management software like Exercise.com, payment processing fees, credit card terminals, gym POS system, referral commission payouts, custom branded gym apps, etc.) (2% of revenue) – $20,000

- Office Supplies (1% of revenue) – $10,000

- Gym Supplies (cleaning materials, towels, etc.) (4% of revenue) – $40,000

- Other (miscellaneous expenses) (2% of revenue) – $20,000

- Total Expenses – $700,000

- Profit Before Taxes – $300,000

Again, these are rough estimates and each gym’s financial situation can vary. It’s recommended to regularly review and adjust your budget as needed to fit your gym’s unique needs and situation.

Read More: Best Gym Budget Templates

Why Having a Gym Budget is Important for Fitness Businesses

Having a gym budget is vital for several reasons. Firstly, it provides a clear framework for managing your expenses, helping you stay organized and accountable for every dollar spent. By having a budget in place, you can better track and control your costs, identify areas where you may be overspending, and make informed decisions to optimize your financial resources.

Secondly, a gym budget enables you to plan ahead and set realistic financial goals. It allows you to define your revenue targets, evaluate your performance against those targets, and make necessary adjustments to achieve your desired financial outcomes. Additionally, having a budget helps you avoid financial surprises and ensures you have enough resources to cover both expected and unexpected expenses.

Furthermore, having a gym budget can also help you attract investors or secure loans for your fitness business. When potential investors or lenders see that you have a well-thought-out budget in place, it demonstrates your commitment to financial responsibility and increases their confidence in your ability to manage the business effectively. A budget can serve as a powerful tool to showcase the financial viability and growth potential of your fitness business, making it more attractive to external funding sources.

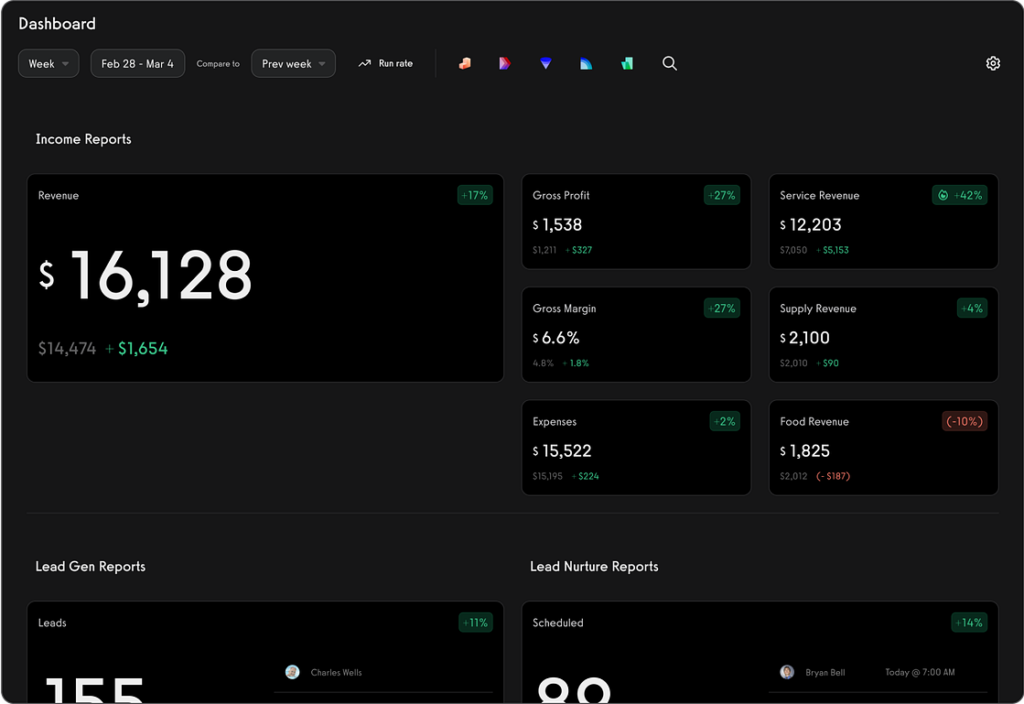

And, of course, with the best gym business management software from Exercise.com, then you have all of the gym business reports, analytics, and payments data you need to have sophisticated conversations with your accountants, attorneys, and business stakeholders.

Read More:

- How to Get a Gym Loan

- How to Start a Gym

- How much money do you need to open a gym?

- Best Gym Reporting Software

Understanding the Benefits of Creating a Gym Budget

Creating a gym budget offers many advantages. One key benefit is that it allows you to allocate your financial resources effectively. By analyzing your income and expenses, you can allocate funds to different areas of your gym according to their priority and importance. This ensures that critical aspects such as equipment maintenance, staff salaries, marketing campaigns, and utility costs are adequately accounted for and funded.

A budget also helps you identify potential areas for cost reduction and optimization. By closely monitoring your expenses, you can spot areas where you may be overspending or where there are opportunities to negotiate better prices or find cost-saving alternatives. This can ultimately lead to increased profitability and financial stability for your gym.

Another advantage of creating a gym budget is that it allows you to set financial goals and track your progress towards achieving them. By setting specific targets for revenue, expenses, and profitability, you can measure your gym’s financial performance and make informed decisions to improve it. Regularly reviewing your budget and comparing it to your actual financial results can help you identify any deviations or areas where adjustments may be needed.

In addition, a gym budget can also serve as a tool for communication and transparency within your organization. By sharing the budget with your staff and stakeholders, you can ensure that everyone is aware of the financial goals and constraints of the gym. This can foster a sense of accountability and encourage collaboration in finding ways to achieve those goals while staying within the allocated budget.

Step-by-Step Guide to Creating a Gym Budget

Now that we understand the importance and benefits of having a gym budget, let’s dive into the step-by-step process of creating one. Follow these guidelines to create a comprehensive and effective budget for your fitness business:

1. Analyze Your Current Financial Situation

The first step in creating a gym budget is to assess your current financial situation. This involves gathering and analyzing your financial statements, such as income statements, balance sheets, and cash flow statements. Understanding your current financial position will give you a baseline to work from and help you identify areas for improvement.

2. Determine Your Gym’s Financial Goals and Objectives

Next, it is essential to define your gym’s financial goals and objectives. This could include targets for revenue growth, profitability, membership numbers, or any other financial metrics that are important to your business. Clearly defining your goals will guide your budgeting decisions and help you stay focused on achieving your financial targets.

3. Identify Key Expenses in Running a Gym Facility

Identify and categorize the key expenses associated with running a gym facility. This may include rent or mortgage payments, utilities, equipment maintenance and repairs, staff salaries, marketing and advertising costs, insurance, and other miscellaneous expenses. Be thorough in identifying all the potential costs to ensure your budget covers all necessary expenditures.

4. Estimate Monthly Operating Costs for Your Fitness Business

Estimate the monthly operating costs for your fitness business. Break down your identified expenses into monthly increments to gain a clear understanding of your cash flow requirements. This step will help you determine how much revenue you need to generate to cover your ongoing expenses and stay financially viable.

5. Allocate Funds for Equipment and Maintenance

Allocate funds for equipment purchases and ongoing maintenance. Equipment is a significant investment for any gym, and regular maintenance is necessary to ensure their longevity and functionality. By setting aside funds specifically for equipment and maintenance, you can proactively address any repair or replacement needs and avoid unexpected financial strain.

6. Budget for Staff Salaries and Training Programs

Budget for staff salaries and training programs. Your employees are a vital part of your gym’s success, and ensuring you have enough funds allocated for their salaries and continuous development is crucial. Take into account factors such as base salaries, benefits, bonuses, and any ongoing training or certification costs.

7. Calculate Marketing and Advertising Expenses for Your Gym

Calculate your marketing and advertising expenses. Promoting your gym and attracting new members requires an investment in marketing efforts. Consider costs associated with online advertising, social media marketing, print materials, signage, and any other channels you utilize to reach your target audience. Be sure to allocate sufficient funds to effectively market your fitness business and drive membership growth.

8. Manage Utilities and Facility Maintenance Costs

Manage your utility expenses and facility maintenance costs. Electricity, water, heating, and cooling expenses can quickly add up for a gym facility. Budgeting for these ongoing costs ensures you can maintain a comfortable environment for your members while keeping your utility bills under control. Additionally, allocate funds for facility maintenance to address any repairs or upgrades needed to keep your gym in optimal condition.

9. Anticipate Variable Expenses in Your Gym Budget

Anticipate variable expenses in your gym budget. Variable costs can include unforeseen maintenance issues, unexpected repairs, or fluctuations in certain expenses such as marketing campaigns or equipment purchases. By setting aside a portion of your budget for these variable expenses, you can mitigate their impact on your overall financial plan.

10. Control and Reduce Costs in Your Fitness Business

Implement strategies for controlling and reducing costs in your fitness business. This can include negotiating better contracts with suppliers, exploring energy-saving initiatives, optimizing your staff schedule to minimize overtime expenses, and seeking cost-effective alternatives for equipment or services. Regularly reviewing your budget and identifying areas for cost savings is crucial to maintaining financial health for your gym.

11. Understand Revenue Streams and Income Sources for Gyms

Understand the different revenue streams and income sources for gyms. In addition to membership fees, consider other potential sources of income such as personal training sessions, merchandise sales, fitness classes, or offering premium fitness club amenities for an additional fee. Diversifying your revenue streams can help stabilize your financial position and increase your gym’s profitability.

12. Set Realistic Revenue Targets in Your Budget Plan

Set realistic revenue targets in your gym budget plan. Analyze your historical data, market trends, and industry benchmarks to determine achievable revenue goals. It is essential to strike a balance between ambitious targets that push your gym to grow and realistic projections that align with market conditions and your gym’s current capabilities.

13. Create Strategies for Increasing Membership Sales and Retention Rates

Develop strategies for increasing membership sales and retention rates. As membership fees play a significant role in your gym’s revenue, focusing on member acquisition and retention is vital. Consider offering promotions, referral programs, creating personalized member experiences, and continually evaluating and improving your gym’s offerings to attract and retain members.

14. Plan Special Promotions and Events within Your Budget

Plan special promotions and events within your budget. Hosting special events, workshops, or themed promotions can generate excitement and attract new members. While planning these activities, ensure you allocate enough funds to cover the associated expenses and evaluate their potential return on investment (ROI).

15. Forecast Cash Flow and Track Financial Performance Metrics

Forecast your cash flow and track financial performance metrics. Regularly monitoring your financial performance against your budget helps you stay on track and make informed decisions. Analyzing cash flow projections, key performance indicators (KPIs), and other financial metrics allows you to identify financial strengths and weaknesses and make necessary adjustments to optimize your gym’s financial health.

16. Regularly Review and Adjust Your Gym Budget for Success

Regularly review and adjust your gym budget for success. Your gym’s financial landscape may change over time, and it is essential to adapt your budget accordingly. Conduct regular budget reviews, comparing your actual results against your projections, and make any necessary modifications to ensure your gym remains financially stable and continuously performing at its best.

Creating a comprehensive gym budget is a critical process that can significantly impact the success of your fitness business. By following the step-by-step guide outlined above, you can develop a robust financial plan that puts you in control of your expenses, optimizes your financial resources, and positions your gym for long-term success.

Remember, a well-managed gym budget not only maximizes your profitability but also allows you to provide an exceptional fitness experience to your members, making your gym the preferred choice in a highly competitive industry.

Read More: How do I write a proposal for a gym?