Accounting for Gyms (BIG Gym Accounting Guide)

Master the intricacies of accounting for gyms with this comprehensive guide. Learn to optimize revenue, control expenses, and analyze financial health.

Understanding gym accounting is key for creating gym financial statements and is an important part of learning how to write a gym business plan, learning how to create a gym budget, and learning how to get a gym loan—all important things to consider as tools for helping you open a new gym. Learn all about the basics of accounting for gyms and fitness business (and get some ideas from the example gym financial statements and example gym chart of accounts). Then be sure to empower yourself with the best gym software for managing a growing gym: Exercise.com.

Business, Accounting, and Tax Requirements for a Health and Fitness Related Business

Describe the business accounting and tax requirements for a health and fitness related business:

Business accounting and tax requirements can vary based on the nature of your business, its size, and location. However, here are some general points you may need to consider when running a health and fitness business such as a gym.

1. Business Structure

The structure of your business, such as whether it’s a sole proprietorship, partnership, LLC, or corporation, can have significant implications for your accounting and tax requirements. It’s important to select a structure that suits your business needs and provides the appropriate level of liability protection.

Read More: What is the best business structure for a gym?

2. Business Registration

In many locations, you’ll need to register your business with the appropriate local, state, or national authorities, and obtain any necessary licenses or permits. This process may include obtaining an Employer Identification Number (EIN) from the IRS if you’re in the U.S., which you’ll use for tax purposes.

3. Bookkeeping

Regular and accurate bookkeeping is critical. This involves tracking income and expenses, managing invoices and receipts, and regularly reconciling your books. You’ll also need to track assets like gym equipment and liabilities like loans or accounts payable.

Read More: Gym Bookkeeping Guide

4. Payroll

If you have employees, you’ll need to set up a payroll system to track wages, withhold taxes, and comply with labor laws. You may also need to pay unemployment insurance tax and handle worker’s compensation insurance.

5. Sales Tax

Depending on your location, you may need to collect sales tax on certain goods and services sold, like merchandise or personal training services. You’ll need to understand your local sales tax laws and set up systems to collect, report, and pay these taxes.

6. Income Taxes

You’ll need to report your business income and expenses on your income tax return. The specific forms and schedules you’ll need to use will depend on your business structure.

7. Self-Employment Taxes

If you’re a sole proprietor or partner, you’ll generally need to pay self-employment taxes, which cover Social Security and Medicare.

8. Depreciation

If you invest in gym equipment, you’ll need to track its depreciation for tax purposes. There are specific IRS rules about how to calculate and report depreciation.

9. Financial Statements

You’ll need to prepare regular financial statements, such as profit and loss statements, balance sheets, and cash flow statements. These are important for understanding your business’s financial health, making informed decisions, and reporting your income accurately for tax purposes.

Read More: Gym Financial Statement Examples

10. Professional Help

Given the complexity of business accounting and taxes, it can be a good idea to consult with a certified accountant or a tax advisor, especially when you’re starting out. They can help ensure that you’re meeting all your obligations and taking advantage of any available tax benefits.

This is a basic overview and not an exhaustive list. The exact requirements can vary widely, and you should always consult with a professional for advice tailored to your specific situation.

Practical Gym Accounting Tips for Gym Owners

Absolutely, here are some practical accounting tips for gym owners:

1. Stay Organized

Keeping track of all your financial documents is crucial. Invoices, receipts, payroll details, and tax forms should be systematically stored. Today, there are many software solutions that can help you with digital record keeping.

2. Separate Personal and Business Finances

It’s important to keep your personal and business finances separate to maintain clear financial records and simplify the process of calculating your taxes.

3. Regularly Update Your Books

Regular bookkeeping will help you stay on top of your finances and will make tax time much easier. Updating your books regularly (weekly or monthly) is a good practice.

4. Understand Your Cash Flow

Many businesses fail due to poor cash flow management. Keep a close eye on the money coming in and going out of your business and create forecasts to help anticipate future cash flow.

5. Payroll Management

Accurate payroll management is crucial, not just for your employees’ satisfaction, but for tax purposes too. Any errors in payroll can lead to serious tax issues.

6. Plan for Taxes

Don’t wait until the last minute to think about taxes. Tax planning should be a part of your regular financial planning. Set money aside throughout the year to avoid a large unexpected bill at tax time.

7. Monitor Your Key Performance Indicators (KPIs)

Identify and monitor the KPIs that matter to your business, such as the cost of acquiring new customers, membership retention rate, and average revenue per member. This will help you understand the financial health of your business and guide your decision-making process.

8. Regularly Review Financial Reports

Regularly reviewing your profit and loss statement, balance sheet, and cash flow statement can provide insights into your financial health and help you make informed business decisions.

9. Consider Professional Help

If you’re not confident in your ability to handle your gym’s accounting, it might be worth hiring a professional accountant. They can help you set up your accounting systems, ensure you’re meeting your tax obligations, and provide valuable financial advice.

10. Invest in Accounting Software

Using accounting software can simplify your bookkeeping, improve accuracy, and provide you with valuable financial insights. Many software packages are user-friendly and designed for non-accountants.

Read More: Best Accounting Software for Gyms

Remember, good accounting practices are not just about compliance, they’re an integral part of running a successful business. Regular financial analysis can help you identify opportunities for growth, manage risks, and improve your overall business strategy.

Introduction to Accounting for Gyms

Definition of accounting and its importance in the gym industry

In the dynamic landscape of the fitness industry, where gyms have become a hub for healthy lifestyles, it is crucial to understand the significance of accounting. Accounting can be defined as the systematic method used to record, analyze, and communicate financial information pertaining to an organization’s economic activities.

In the context of gyms, accounting plays a pivotal role in ensuring accurate financial management, enabling owners and managers to make informed decisions to propel their businesses forward. The importance of accounting lies in its ability to provide a clear picture of a gym’s financial health by tracking revenue, expenses, assets, liabilities, and equity.

By maintaining comprehensive records through bookkeeping processes, gym owners can keep track of cash flow patterns and identify areas that require attention or improvement. Moreover, accurate accounting enables gyms to comply with legal requirements such as tax regulations and financial reporting standards specific to their industry.

Overview of the financial aspects involved in running a gym

Running a successful gym involves various financial considerations that necessitate careful management. Firstly, there are upfront costs associated with establishing or acquiring a facility – these may include leasehold improvements, equipment purchases or leases, licensing fees, insurance coverage setup costs, marketing expenses for initial promotion campaigns aimed at attracting members.

Once operational, ongoing expenses must be managed effectively. These typically include rent or mortgage payments for the facility space (if not already covered), utility bills such as electricity and water consumption charges/costs.

Other common overhead costs include maintenance fees for equipment repair and replacement when necessary. Additionally crucial are employee salaries/wages (including potential commissions or bonuses) paid out to staff members working at the gym – from personal trainers and fitness instructors to administrative personnel – who contribute significantly towards providing quality customer service while ensuring smooth daily operations.

A comprehensive understanding of the financial aspects involved in running a gym is fundamental for effective decision-making and long-term sustainability. Proper accounting practices enable gym owners to monitor financial performance, maintain a healthy cash flow, and make informed strategic choices to maximize profitability while delivering exceptional services to their valued members.

Read More:

- How to Create a Gym Business Plan

- How to Create a Gym Budget

- How to Write an Executive Summary for a Gym

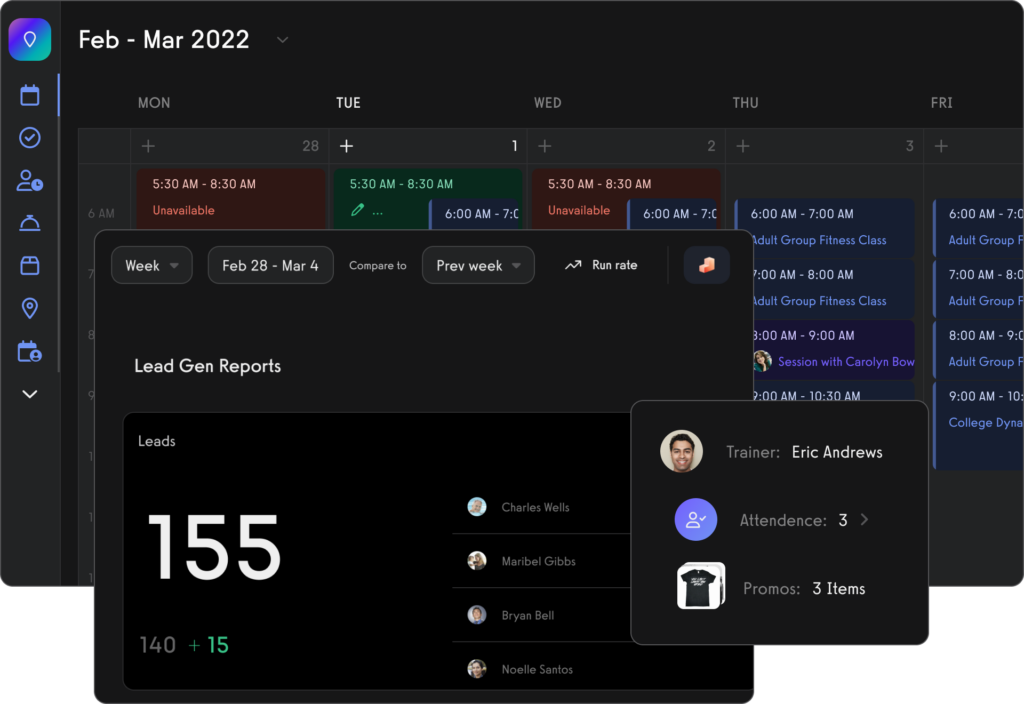

How Exercise.com Can Help

Tired of scrambling around for data? Is your gym accounting a mess? Use the best software for managing a gym with the Exercise.com platform so everything can be nice, neat, and organized.

Read More:

Basic Accounting Principles for Gyms

Accrual vs. Cash Basis Accounting and Their Implications for Gyms

Accrual basis accounting and cash basis accounting are two different methods used to record financial transactions in businesses, including gyms. Understanding the implications of each method is crucial for gym owners to make informed decisions regarding their finances. Accrual basis accounting recognizes revenue when it is earned, regardless of when payment is received, and records expenses when they are incurred, irrespective of when they are paid. This method provides a more accurate picture of a gym’s financial performance over a specific period. It allows gyms to match revenues with the associated expenses in the same accounting period, providing a clearer understanding of profitability. With accrual accounting, gyms can identify trends and fluctuations in revenue and expenses more effectively.

On the other hand, cash basis accounting records revenue only when it is received and expenses only when they are paid. This method provides a simpler approach that matches inflows with outflows directly. While it may be suitable for smaller or cash-based businesses, cash basis accounting may not provide an accurate representation of a gym’s financial health as it does not consider outstanding payments or future obligations. Gyms should carefully consider which method aligns best with their size, complexity, and long-term goals. While accrual basis accounting requires diligent record-keeping and tracking outstanding payments from members or vendors, it offers more comprehensive financial reporting capabilities that can support better decision-making.

Importance of Maintaining Accurate Records and Financial Statements

Maintaining accurate records and financial statements is essential for gyms as it serves multiple purposes such as compliance with tax regulations, monitoring business performance, making informed decisions, attracting investors or lenders if needed, and facilitating audits if necessary. By keeping detailed records of all transactions related to sales, purchases, payroll expenses, rent, utilities, and other financial activities, gyms ensure transparency and accountability.

Accurate records enable the gym management to track revenue trends, monitor expenses, and identify areas for cost optimization or potential opportunities for growth. Financial statements such as the income statement, balance sheet, and cash flow statement provide a comprehensive overview of a gym’s financial performance.

These statements help gym owners assess profitability, liquidity, solvency, and overall financial stability. Timely preparation and analysis of these statements allow gyms to make necessary adjustments to their operations if they encounter any financial challenges or maximize their strengths by capitalizing on profitable areas.

Moreover, maintaining well-organized records and financial statements can simplify tax filing processes. It ensures compliance with tax regulations by providing accurate information necessary for calculating taxable income, deductible expenses, and other relevant tax obligations.

Read More: Gym Financial Statement Examples

Understanding the Chart of Accounts Specific to Gyms

The chart of accounts is a crucial component of a gym’s accounting system that organizes various categories for recording financial transactions. Understanding the specific chart of accounts tailored to gyms is important in order to capture relevant data accurately. The chart of accounts typically includes main categories such as assets (equipment inventory), liabilities (loans or payables), equity (owner’s investment or retained earnings), revenue (membership fees or personal training income), cost of goods sold (inventory costs), operating expenses (rent, utilities), payroll expenses (wages), among others.

However, within each category are subcategories specific to gyms that provide more detailed information about different revenue streams or expense types. For example, under revenue accounts in a gym’s chart of accounts, you may find subcategories like “membership fees,” “personal training,” “group classes,” “merchandise sales,” etc. This level of specificity allows gyms to track each source of revenue separately and evaluate their performance individually.

Understanding the unique chart of accounts specific to gyms helps streamline the recording and reporting process, ensuring accurate financial data for decision-making and analysis. It also facilitates consistency in financial reporting, allowing gyms to compare their performance against industry benchmarks or historical data.

Read More: Gym Chart of Accounts Examples

Revenue Recognition in Gym Accounting

Different sources of revenue for gyms (membership fees, personal training, classes, etc.)

Gyms generate revenue from various sources, each requiring careful consideration for proper accounting. The primary source of income for most gyms is membership fees. These fees can be charged on a monthly or annual basis, depending on the membership package chosen by the customer.

Additionally, gyms often offer personalized services like personal training sessions or specialized classes such as yoga or spin classes. These services are typically charged separately and contribute to the overall revenue generated by the gym.

In order to accurately track and account for these different revenue streams, it is essential for gym owners to establish specific accounts within their financial system to categorize income from each source appropriately. This level of detail allows for better analysis and decision-making as it provides insights into which services are most profitable and popular among members.

Proper recognition and allocation of revenue based on different membership types or packages

Recognizing and allocating revenue based on different membership types or packages is crucial in ensuring accurate financial reporting in gym accounting. Gym memberships may vary in terms of duration (monthly, quarterly, annual) and level of access (basic, premium). Each membership type should be assigned a distinct code or identifier within the accounting system to facilitate proper recognition and tracking.

For instance, if a gym offers both basic and premium memberships with varying prices, it is important to correctly allocate each payment based on the member’s chosen package. This ensures that the appropriate portion of revenue is attributed to each membership category when generating financial statements.

It is also important to consider any discounts or promotions offered to potential members when recognizing revenue. If a discount is provided upfront but spread over several months through reduced monthly payments, it must be properly accounted for during that period rather than recorded entirely at once.

Handling deferred revenue and recognizing it over time

Deferred revenue occurs when a gym receives payment for services that have not yet been rendered or membership periods that extend beyond the current accounting period. This situation often arises when gyms offer prepaid plans or receive advance payments from members.

To handle deferred revenue, gym owners must ensure accurate record-keeping and recognition in their accounting systems. This involves initially recording the received payment as a liability on the balance sheet until the corresponding services are delivered or the membership period begins.

As each month passes, a portion of this deferred revenue is recognized as earned income on the income statement, reflecting the services provided during that specific period. Properly managing deferred revenue is crucial for accurate financial reporting as it prevents misrepresentation of current cash flow and provides a clear picture of actual ongoing revenue streams in line with the services provided by the gym.

Overall, revenue recognition in gym accounting requires meticulous attention to detail to accurately account for various sources of income, allocate revenue based on different membership types, and handle deferred revenue appropriately. Following these practices enables gym owners to maintain transparent financial records and make informed decisions regarding business operations and growth strategies.

Expense Management in Gym Accounting

Identifying common expenses incurred by gyms

Gyms, like any other business, have a range of expenses that need to be carefully managed to ensure smooth operations and financial stability. Firstly, the most significant expense for gyms is often rent or lease payments for the facility.

Gym owners must negotiate favorable terms and consider factors such as location, size, and proximity to target customers. Additionally, utilities such as electricity, water, and gas are recurring expenses that need to be monitored closely.

Another vital area of expense identification in gym accounting is equipment maintenance. Gyms rely heavily on their equipment to provide an optimal workout experience for their members.

Regular maintenance and repair costs must be budgeted for to keep the equipment in top condition while minimizing downtime. It is essential to establish preventive maintenance protocols to prolong equipment lifespan and avoid costly repairs or replacements.

Tracking variable expenses such as inventory replenishment or marketing campaigns

In addition to fixed expenses, gyms also have variable costs that need careful tracking. Inventory replenishment is one such expense that arises when gyms offer items like supplements or merchandise for sale. Keeping an eye on inventory levels is crucial to avoid overstocking or running out of popular products.

Employing appropriate inventory management systems can help streamline this process by automating stock tracking and generating reports on product performance. Marketing campaigns are another area where variable expenses play a significant role in gym accounting.

Promoting the gym through various channels like social media advertising, print media, or sponsorships incurs costs that vary depending on the scale and scope of each campaign. Tracking these expenses closely allows gym owners to evaluate the return on investment (ROI) from different marketing initiatives and optimize future spending accordingly.

Budgeting techniques to control costs and maximize profitability

To ensure financial stability and profitability, gyms must implement effective budgeting techniques. Start by creating a comprehensive budget that includes all anticipated expenses and revenue projections for the upcoming period.

This serves as a roadmap for financial decision-making and allows for better cost control. One technique often employed in gym accounting is zero-based budgeting.

This approach requires justifying every expense from scratch, regardless of past spending patterns. It encourages critical examination of each line item and eliminates unnecessary or redundant costs.

By scrutinizing expenses in this manner, gym owners can identify areas where savings can be achieved without compromising the quality of services provided. Another useful technique is variance analysis, which involves comparing actual expenses against budgeted amounts on a regular basis.

This allows gym owners to detect any deviations promptly and take corrective action as needed. For example, if utilities costs are significantly higher than projected, energy-saving measures or negotiation with service providers may be required.

Expense management in gym accounting requires a careful analysis of common expenses such as rent, utilities, equipment maintenance, variable costs like inventory replenishment and marketing campaigns. By implementing effective tracking methods and employing budgeting techniques like zero-based budgeting and variance analysis, gym owners can exercise better control over their costs while maximizing profitability.

Payroll and Employee-related Accounting in Gyms

Wage calculation methods (hourly vs salary) and their impact on payroll accounting

When it comes to compensating employees in the gym industry, two common wage calculation methods are hourly wages and salary payments. Each method has distinct implications for payroll accounting. Hourly wages are generally utilized for employees who work variable hours, such as fitness trainers or front desk staff (get more info in our gym front desk staff job description template).

With this approach, gym owners must accurately track the number of hours worked by each employee to calculate their pay. Hourly wage calculation involves multiplying the number of hours worked by the agreed-upon hourly rate.

It is crucial for gym owners to implement an efficient timekeeping system to ensure accurate record-keeping. This will not only aid in fair compensation but also simplify payroll accounting procedures.

Gym management software or time clock systems can be leveraged to streamline this process, facilitating reliable data collection. On the other hand, salary-based payments are commonly employed for employees with fixed working hours or positions that require a consistent level of responsibility, such as managers or administrative staff.

With salaried employees, a predetermined amount is paid periodically regardless of the actual number of hours worked within a defined pay period. For instance, if a gym manager receives an annual salary of $50,000 paid semi-monthly, they will receive the same amount in each paycheck regardless of whether they work 40 hours one week and 35 hours another.

Deductions for employee benefits such as health insurance or retirement plans

Employee benefits play a significant role in attracting and retaining talented individuals within the gym industry. Common benefits offered include health insurance plans and retirement savings options like 401(k) plans or individual retirement accounts (IRAs). From an accounting perspective, deductions for these benefits need careful consideration and accurate reporting.

Firstly, let’s delve into health insurance deductibles. Gym owners may choose to provide health insurance coverage to their employees, either by fully covering the premium or sharing the cost with employees.

In the latter case, deductions are made from employee wages to cover their portion of the premiums. This requires meticulous record-keeping and coordination with insurance providers to ensure accurate calculations and timely payments.

Similarly, retirement plans also involve deductions from employee wages, typically on a pre-tax basis. These contributions are made towards future retirement savings, helping employees build a financial safety net for their post-work years.

Gym owners must adhere to regulatory requirements for such programs, ensuring they comply with contribution limits set by government entities like the Internal Revenue Service (IRS). Proper accounting practices include accurately tracking and reporting employee contributions while ensuring that payroll deductions align with established guidelines.

Compliance with tax regulations related to employee compensation

Adhering to tax regulations related to employee compensation is crucial for gym owners in order to avoid penalties or legal issues. It is essential that gym establishments stay updated on tax laws, as non-compliance can result in significant financial consequences.

One important aspect of tax compliance is accurately determining an individual’s employment status – whether they are classified as an employee or an independent contractor. Misclassification can lead to tax liabilities and potential legal complications later on if challenged by taxing authorities.

Gym owners should consult legal counsel or tax experts for guidance in classifying workers correctly based on relevant guidelines and criteria set forth by governmental agencies. Additionally, payroll taxes must be handled diligently.

Employers are required to withhold income taxes from their employees’ wages and remit them periodically along with employer-paid taxes like Social Security and Medicare contributions. Accurate calculation of these taxes as well as proper filing and timely remittance demonstrate compliance with tax regulations.

Payroll accounting in gyms encompasses various aspects ranging from wage calculation methods (hourly vs salary) that impact compensation structures, through deductions for benefits like health insurance and retirement plans, to compliance with tax regulations related to employee compensation. Gym owners must strive for meticulous record-keeping and ensure compliance with legal requirements in order to create a smooth and efficient payroll system that benefits both employees and the business as a whole.

Asset Management in Gym Accounting

Tracking gym equipment purchases, depreciation, maintenance costs, etc.

When it comes to managing gym assets, keeping a meticulous record of equipment purchases is essential. Gym owners should maintain a detailed inventory list that includes information such as the date of purchase, cost, manufacturer details, and any warranties or service agreements associated with each item.

This comprehensive inventory ensures accurate tracking of assets and facilitates efficient maintenance scheduling. Additionally, gym equipment depreciates over time due to wear and tear.

Properly accounting for depreciation allows owners to allocate expenses over the useful life of the equipment. Depreciation methods commonly used in gym accounting include straight-line depreciation and declining balance methods.

The choice depends on factors like the expected lifespan of the equipment and its residual value. Maintenance costs are another important aspect of asset management in gyms.

Regular repairs and maintenance not only help prolong the lifespan of equipment but also ensure member safety. Keeping a logbook for all maintenance activities helps monitor expenses incurred for servicing various machines or fixtures within the facility.

Inventory management techniques for items like supplements or merchandise sold at the gym

For gyms that sell supplements or merchandise on-site, effective inventory management becomes crucial. Maintaining optimal stock levels helps avoid shortages or excessive holding costs while ensuring products are readily available to meet customer demands.

Implementing an automated inventory management system can streamline operations by enabling real-time tracking of stock levels, generating alerts for low-stock items, and facilitating efficient reordering processes. This technology can incorporate barcode scanning capabilities to accurately record sales transactions and update inventory counts instantaneously.

Moreover, employing forecasting techniques based on historical sales data can aid in making informed decisions about adjusting stock levels during peak periods or anticipating demand fluctuations. By analyzing consumer trends and preferences regularly, gym owners can adapt their inventory management strategies to optimize profitability while minimizing wasted resources.

Evaluating return on investment (ROI) for major asset purchases

Making significant asset purchases, such as upgrading equipment or expanding the gym space, requires careful financial analysis to assess the return on investment (ROI). Calculating ROI involves comparing the expected financial benefits against the costs associated with the project.

When evaluating ROI for major asset purchases, gym owners should consider factors such as increased membership revenues, reduced maintenance costs due to newer equipment, and potential operational efficiencies. They must also account for any additional expenses incurred during installation or renovation.

Conducting a thorough cost-benefit analysis helps determine whether the investment is financially viable in both the short and long term. By setting appropriate benchmarks and regularly monitoring key financial metrics post-investment, gym owners can assess whether their decisions align with their business objectives and adjust strategies accordingly.

Effective asset management is crucial in maximizing profitability and ensuring smooth operations in gyms. By meticulously tracking equipment purchases, depreciation, and maintenance costs, gym owners can maintain accurate records while optimizing resource allocation.

Implementing efficient inventory management techniques enables gyms to meet customer demands while avoiding excessive holding costs or shortages of supplements or merchandise. Moreover, evaluating ROI for major asset purchases ensures wise investment decisions that align with long-term business goals.

Financial Analysis Tools for Gym Owners

Key Performance Indicators (KPIs) used to assess the financial health of a gym

Running a successful gym requires not only providing excellent services and facilities but also effectively managing the financial aspect of the business. Key performance indicators (KPIs) provide valuable insights into the financial health of a gym and help owners make informed decisions. One crucial KPI is membership growth rate, which measures the percentage increase or decrease in the number of members over a specific period.

By monitoring this indicator, gym owners can evaluate their marketing efforts, customer retention strategies, and overall business performance. Another important KPI is average revenue per member (ARPM), which calculates the average amount of revenue generated by each member within a given timeframe.

This metric helps gauge how successfully gyms are cross-selling additional services such as personal training sessions or classes to their members. By targeting an increase in ARPM over time, gym owners can focus on upselling strategies to maximize revenue potential.

Furthermore, tracking cost per member acquisition (CPMA) is crucial for assessing marketing efficiency and budget allocation. CPMA measures how much it costs to acquire a new member and allows gym owners to evaluate the return on investment from their marketing campaigns.

By monitoring this metric regularly, they can identify opportunities to optimize marketing channels or adjust pricing strategies based on cost-effectiveness. Additionally, other KPIs like customer churn rate, revenue growth rate, and profit margin are essential for assessing overall financial performance and identifying areas of improvement.

Understanding Gym Accounting Principles

Understanding accounting principles and using effective financial analysis tools are critical for managing gyms successfully. By implementing proper accounting practices, such as accrual basis accounting and maintaining accurate records, gym owners can make informed decisions about revenue recognition and expense management that contribute to long-term profitability.

Furthermore, by utilizing key performance indicators (KPIs) to assess the financial health of their gym, owners can gain valuable insights into membership growth, average revenue per member, cost per member acquisition, and other relevant metrics. These indicators help identify strengths and weaknesses in the business, enabling owners to make data-driven decisions that optimize operations and drive financial success.

With a solid understanding of accounting principles and the ability to analyze financial data effectively, gym owners can navigate challenges, adapt strategies based on performance insights, and guide their gyms towards sustainable growth. By leveraging these tools and practices, gym owners can create a financially sound environment that not only benefits their business but also enhances the overall experience for gym members.

Read More:

- How to Increase Profit in a Gym

- How profitable is owning a gym?

- Most Profitable Fitness Business Models

What are the duties of an accountant in a gym?

The duties of an accountant in a gym may include preparing and analyzing financial statements, managing payroll, handling accounts payable and receivable, managing tax filings, tracking expenses, and providing financial advice to the gym owners or managers. Exercise.com’s software can assist with some of these tasks by providing streamlined billing, financial reporting, and payroll functionality.

What category is gym expense?

In a business context, gym expenses could be categorized under operating expenses, as they are costs associated with running the business. For individuals, gym membership fees are typically considered personal expenses, but in certain cases, they may be tax-deductible if they are necessary for medical care.

How do you calculate gym revenue?

Gym revenue is calculated by adding together all income from various sources such as membership fees, personal training services, class fees, and ancillary revenue from merchandise or refreshments sales. Automated billing and reporting features from platforms like Exercise.com can help in accurately calculating this.

What is accounts receivable in a gym?

Accounts receivable in a gym represents the money that gym members owe for services like membership fees, personal training sessions, or other services which have been used but not yet paid for. Exercise.com’s software has built-in tools to manage these transactions effectively.

What are four tasks for gym accountants?

Four tasks for gym accountants might include handling payroll, managing accounts payable and receivable, tracking and categorizing expenses, and preparing financial statements. Platforms like Exercise.com provide features to make these tasks easier and more streamlined.

What business category is a gym?

A gym typically falls under the “Health and Fitness” category in business classifications. More specifically, it might be classified under “Fitness Centers” or “Physical Fitness Facilities.”

What type of enterprise is a gym?

A gym is typically a for-profit enterprise, operating with the goal to make a profit by providing fitness services and amenities to its members.

Can gym equipment be a business expense?

Yes, gym equipment purchased for business use, like in a gym or fitness center, can be considered a business expense and may be eligible for depreciation over time.

What are COGS for a gym?

COGS (Cost of Goods Sold) for a gym typically includes the direct costs attributable to the production of the goods sold by a gym. This could include the cost of personal training sessions, group classes, or any products sold.

How do gym owners get paid?

Gym owners typically get paid from the profits their gym makes. This could come from membership dues, personal training fees, group class fees, and other services or products sold by the gym.

What are the liabilities of a gym?

Gym liabilities could include loans taken out to start or improve the business, money owed to suppliers, unpaid wages, and accrued expenses.

Is gym equipment a current asset?

Gym equipment is considered a fixed or long-term asset, not a current asset, because it’s used over a longer period and not easily converted into cash.

What is the SIC category of fitness?

The Standard Industrial Classification (SIC) for fitness and recreational sports centers is 7991.

How can Exercise.com help my gym?

Exercise.com provides comprehensive gym management software that can help in numerous ways, from scheduling and member management to workout programming and ecommerce. It offers tools for billing, payroll, reporting, client and lead management, assessments, and more, which can help in streamlining operations, improving member services, and enhancing the overall management of your fitness business.