What is the best business structure for a gym? (LLC vs. C-Corp vs. S-Corp)

The best business structure for a gym is typically a Limited Liability Company (LLC) due to its flexibility, protection of personal assets, and tax benefits.

Here’s what you need to know to determine the best legal structure for a gym. Deciding the best business structure for gyms is nuanced but doesn’t have to be a complicated issue. Check out this guide to learn more about the best business structure for a gym, gym LLC basics, learn what kind of business a gym is considered (retail, service, etc.), what industry is a gym in, business ideas for a gym, how to form an LLC for gym businesses in all 50 states, and more.

| Rank | Gym Entity Structure | Pros | Cons |

|---|---|---|---|

| 1 | Limited Liability Company (LLC) | – Limited liability protection – Flexible management structure – Pass-through taxation | – Can be more expensive to form than a sole proprietorship or partnership – Varying state regulations |

| 2 | S Corporation (S Corp) | – Limited liability protection – Pass-through taxation – Potential tax savings on self-employment tax | – Strict operational processes and regulations – Limited to 100 shareholders – Shareholders must be U.S. citizens/residents |

| 3 | C Corporation (C Corp) | – Limited liability protection – Easier to raise capital – Unlimited number of shareholders – Perpetual existence | – Double taxation (corporate and personal levels) – Complex and costly to form and maintain – Rigorous regulatory requirements |

| 4 | Limited Liability Partnership (LLP) | – Limited liability protection for partners – Pass-through taxation – Flexible management | – Varying state regulations – Not available in all states – Possible unlimited liability for certain obligations |

| 5 | Limited Partnership (LP) | – Limited liability for limited partners – General partners have control | – General partners have unlimited liability – More complex to establish |

| 6 | Partnership (General) | – Easy to establish – Shared financial commitment – Combined expertise and resources | – Joint and individual liability – Potential for conflicts – Shared profits |

| 7 | Sole Proprietorship | – Easy and inexpensive to form – Owner has complete control – Simplified tax filing | – Unlimited personal liability – Harder to raise capital – Business ends with owner |

Some aspects of opening a new gym are exciting. Choosing a name, picking out what equipment you need for a new gym, designing a gym layout, and designing your own custom-branded fitness app are just a few of the more fun parts of starting a fitness business. But unfortunately, not everything will be so pleasant. In fact, some of it can be downright confusing (ex: figuring out the LLC gym setup documents in your state). Deciding the best business structure for a gym is one such issue. Check out our full gym legal guide and then read on for more information on choosing the best gym business structure.

If you’re starting a gym business, then choosing the right business structure is essential for legal protection and long-term success. Whether you’re considering an LLC for a gym, forming a gym corporation, or exploring other gym ownership models, selecting the right structure for a gym can impact liability, taxes, and operations. Get access to all the free fitness templates you need, including gym business plan templates, legal guides, and licensing resources to help streamline your gym startup.

So, what type of business is a gym? The fitness industry includes a range of business models, from independent fitness LLCs to large gym corporations like Planet Fitness. If you’re asking, “Is a gym a service business?” or “Is a gym retail?” the answer depends on its business structure. While gyms provide services, they may also sell products, making them a blend of service and retail. Understanding legal requirements for opening a gym, gym licenses and permits costs, and whether a gym is considered retail space are key factors in determining how to structure your gym business.

Whether you’re starting a gym in California or starting a gym in Florida or starting a gym in Texas, the gym zoning requirements and other gym legal requirements will be different. Regardless of where you open a gym, or maybe you are researching gyms for sale near you, selecting the right gym business entity can protect your assets and maximize profitability. With Exercise.com, you can manage memberships, automate billing, and streamline gym operations efficiently. Get a demo now and see how our platform helps gym owners grow their businesses.

From understanding what industry a gym falls under to determining if owning a gym is profitable, Exercise.com provides the best gym management software for fitness business owners. Whether you’re opening a gym, managing a fitness LLC, or running a gym corporation, our platform helps streamline operations, increase revenue, and improve member engagement. Get a demo now.

The best gym management software can help your new gym run smoothly so you can turn a profit quickly. Use Exercise.com to run a successful gym with professional grade gym software that will help you increase gym revenue and profit.

Use the professional’s solution for managing a gym: Exercise.com.

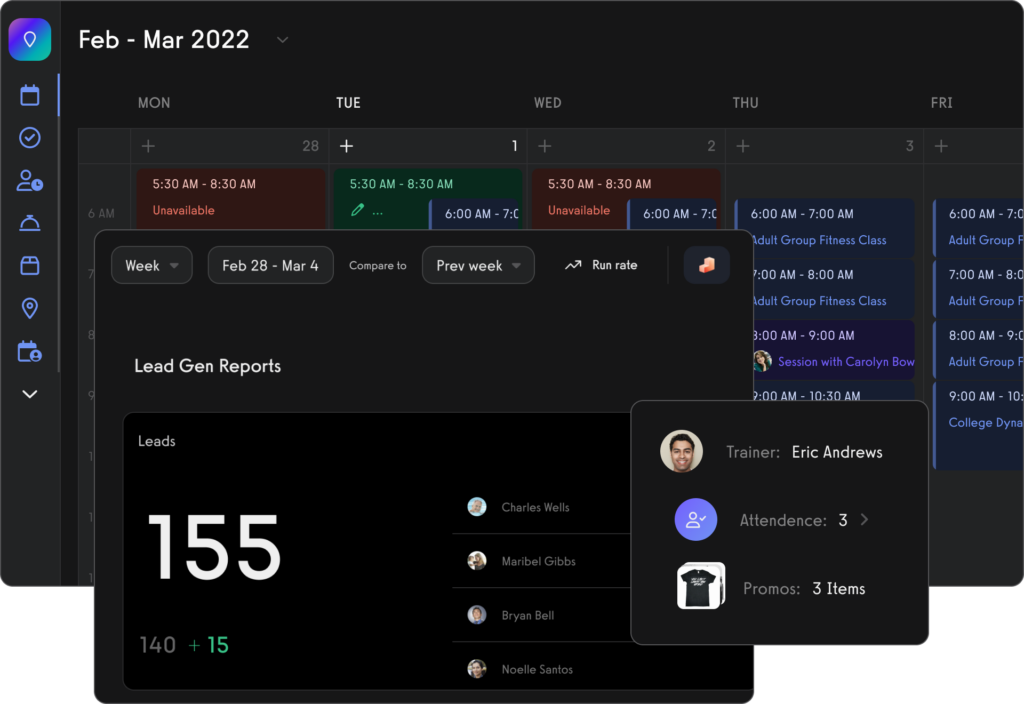

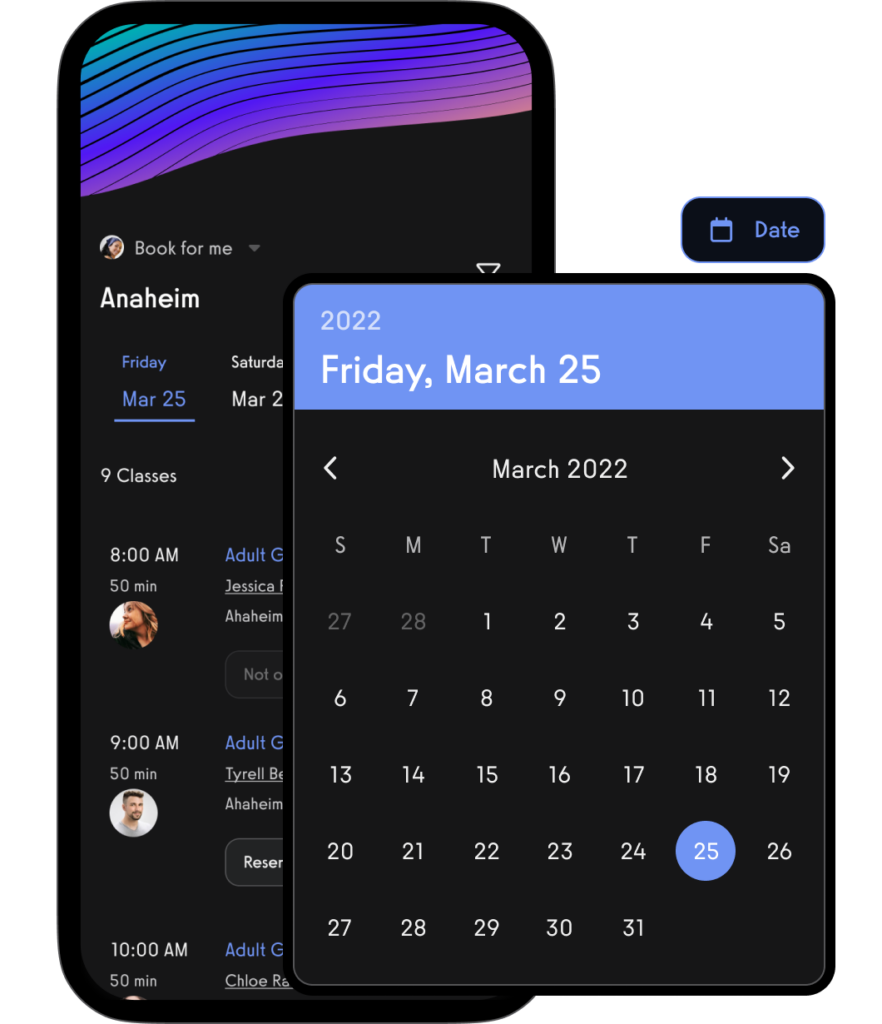

Robust booking and scheduling.

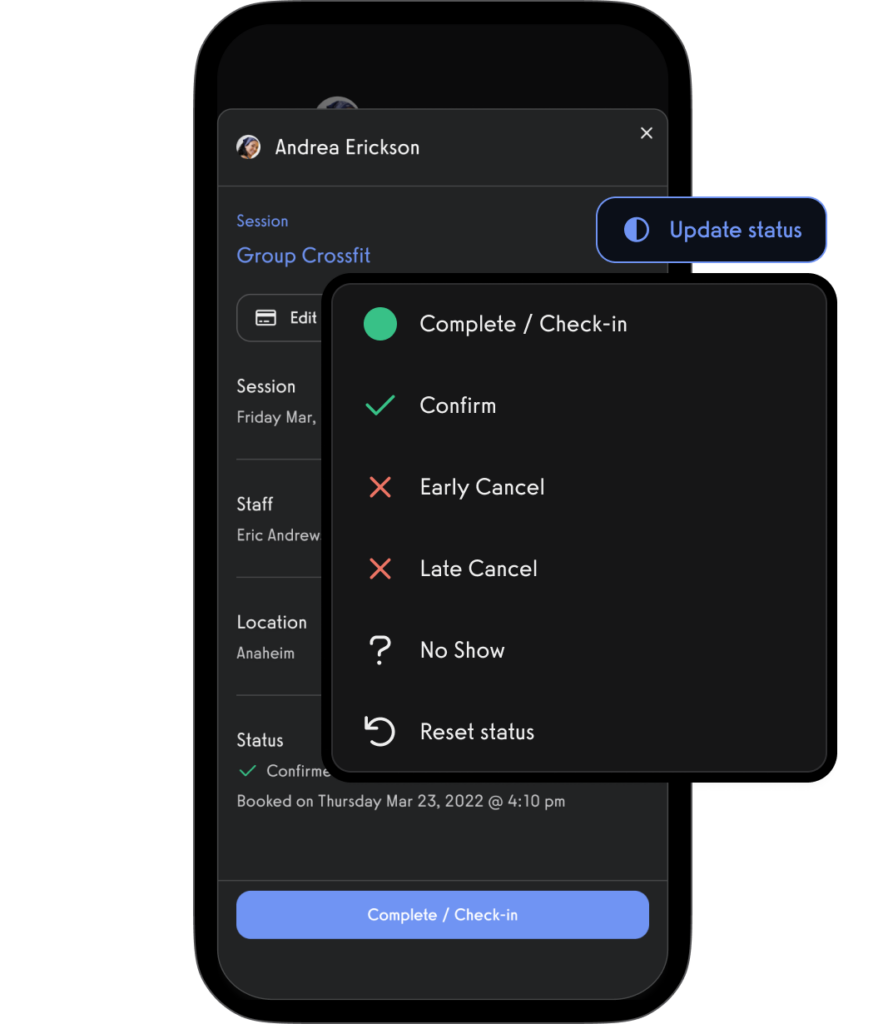

Gym check-ins.

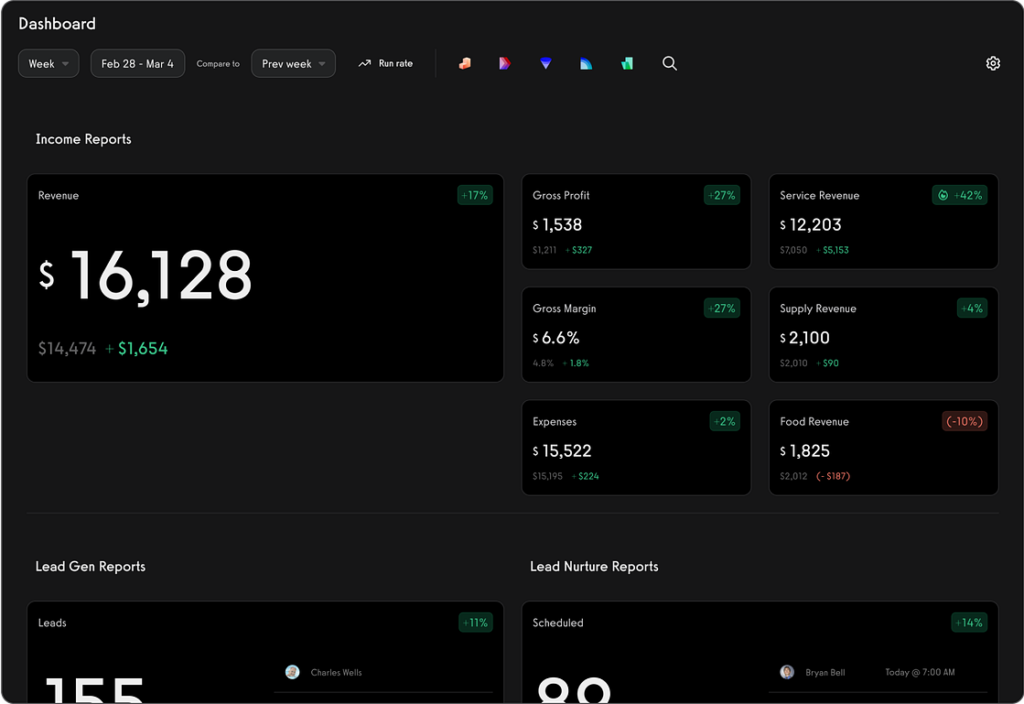

Advanced reporting.

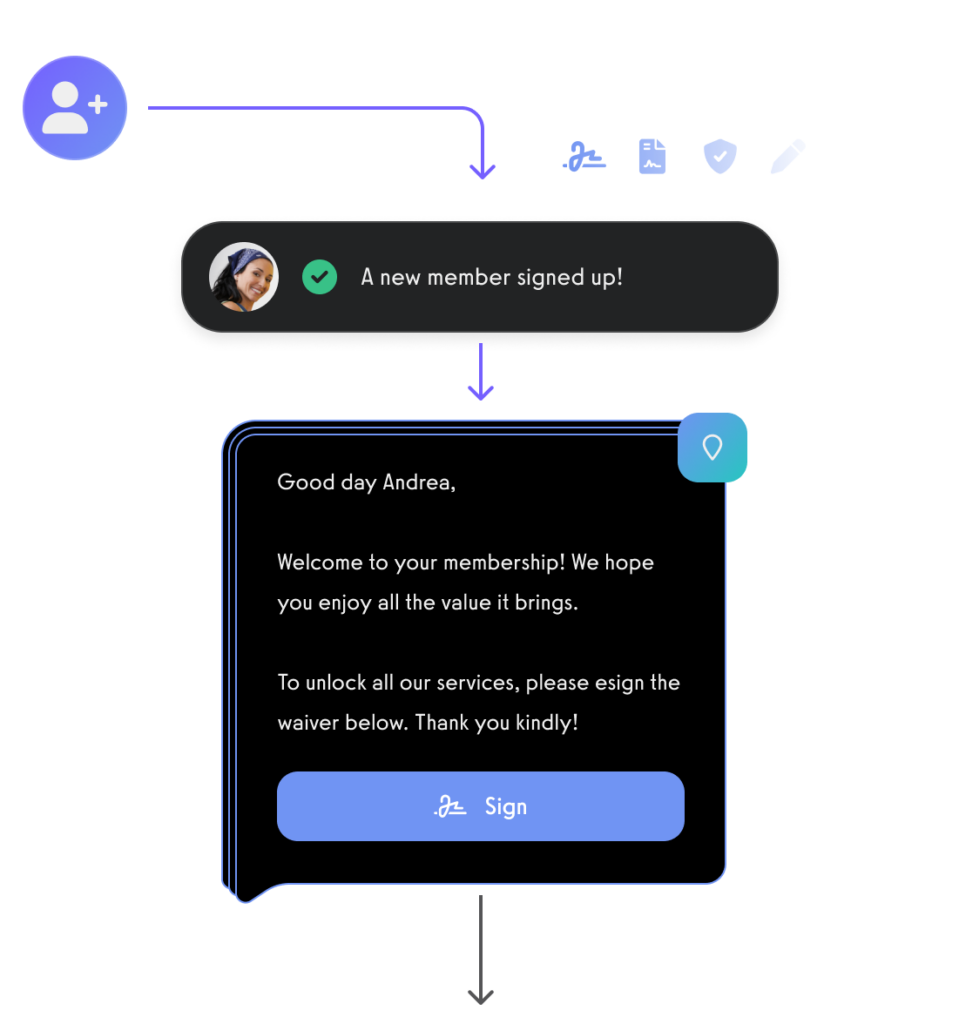

Waivers, assessments, e-signatures, and more to make sure your gym’s legal requirements are buttoned up.

And much, much more.

Choosing a Gym Business Entity Structure

If you’re the gym’s only owner, it might seem easiest to go ahead and form your gym business as a sole proprietorship, but that means your personal finances will be on the line for all of the business’s successes and failures. Ready to find out if there’s a better way? Then keep reading.

- C-corps are complicated to set up and maintain, and they are generally meant for large companies.

- Before being granted an S-corp status, a business must meet a laundry list of IRS requirements.

- LLCs are an easy and flexible way for single-owners or partnerships to achieve some of the protections of corporations.

Advantages of an LLC for a Gym

- Personal Asset Protection: LLCs provide a legal separation between your personal assets and the business liabilities. This means in case of lawsuits or debts, your personal property, like your home or car, is typically protected.

- Tax Flexibility: LLCs offer pass-through taxation, where the business income is taxed only once, at the personal income level, avoiding the double taxation found in corporations.

- Credibility and Growth: Forming an LLC can enhance your gym’s credibility with customers and potential investors. It also provides a clear structure for adding partners or expanding the business.

- Operational Flexibility: LLCs have fewer compliance requirements compared to corporations, offering more flexibility in how you manage and operate your gym.

Considerations for Other Structures

- Sole Proprietorship: While simpler and with less paperwork than an LLC, it offers no personal liability protection, which is a significant risk in the fitness industry.

- Corporation (C-Corp or S-Corp): While it provides personal liability protection, it’s more complex to manage and may lead to double taxation (in the case of C-Corps). S-Corps can avoid double taxation but have restrictions on shareholders.

- Partnership: Suitable if you’re planning to run the gym with a partner, but like a sole proprietorship, it may lack personal liability protection unless structured as a Limited Liability Partnership (LLP).

Choosing the right legal structure is critical for your gym’s long-term success and should align with your business goals and needs. It’s advisable to consult with a legal expert to make an informed decision based on your specific circumstances. While an LLC is generally recommended for its protection and flexibility, the best choice depends on your unique business situation.

The Bottom Line: The Best Business Structure For Gyms

No matter which way you structure your new gym, there will be pros and cons. However, this is a huge decision that will drastically impact your new fitness business. Unless you have experience in this area, it would be wise to seek professional advice before deciding on the best business structure for your gym.

The right gym management software can help turn you into a business pro. Book a demo to get started!

Should my gym be a C-Corp?

A C-corporation is a legal structure that creates separation between the owner’s assets and the business’s assets. Most major corporations are structured as C-corps.

PROS:

- Because the owners’ assets are not lumped in with the business’s assets, if the business should fail, the owner’s assets are not at risk.

- A C-corp is not attached to any one person. While shareholders and even owners may change over time, the C-corp still maintains its structure.

CONS:

- Because the owner’s assets and the business’s assets are separated, each is taxed individually. Therefore, if the owner takes money from the business (in the form of a dividend), it will be taxed first as income for the business and then as income for the owner. In other words, this creates a situation of double taxation.

- C-corps are complicated to set up and maintain, and they are typically meant for large companies (over 100 people).

Should my gym be an S-Corp?

An S-corporation (sometimes called an S-subchapter or “pass-through entity”) is meant to give smaller companies (fewer than 100 people) the benefits of a corporation without the burden of double taxation. S-corps generally pay no corporate taxes; instead, all profits and losses pass through to the owners and shareholders, who report them on their personal taxes.

PROS:

- Along with protecting the owner’s assets, a smaller tax bill is the biggest benefit of being an S-corp. This is due to the lack of corporate taxes, but also due to things like deductions on business expenses and limited tax-free distributions to employees who are also shareholders.

CONS:

- Before being granted an S-corp status, a business must meet a laundry list of IRS requirements. This can be a huge hassle for anyone not used to navigating government paperwork.

- Even if the business manages to gain S-corp status, the IRS can still terminate that status at any time if the business doesn’t manage its money completely and transparently by the book.

Should my gym be an LLC?

Limited liability companies (LLCs) are a way for single-owners or partnerships to achieve some of the protections of corporations. Requirements vary by state, however, so you will need to investigate the rules for your specific location.

PROS:

- As the name suggests, owners and shareholders are generally not personally liable for the business’s debts if things should go south.

- Similar to an S-corp, the LLC’s profits and losses pass through to the owners, who report them on their personal taxes.

- Unlike corporations, there are far fewer restrictions on who may be considered an owner or shareholder.

- While there are still paperwork hoops that must be jumped through, LLCs are far easier to set up and maintain than corporations.

CONS:

- LLCs are attached to a specific member(s). Therefore, the LLC will be terminated in the event of a sale, retirement, or death.

- LLCs may be subject to self-employment tax, which also results in higher taxes for employees. You may wish to hire an accountant or business attorney to help you make sure your LLC is structured properly to avoid this.

Should a gym be an LLC or S Corp?

The choice of legal structure, such as LLC (Limited Liability Company) or S Corp (S Corporation), for a gym depends on various factors and should be determined after consulting with a qualified attorney or accountant who is familiar with your specific circumstances. Both LLCs and S Corps provide liability protection for gym owners, but they have different tax implications and requirements. An LLC offers flexibility in management and taxation, while an S Corp may provide certain tax advantages for owners who receive salaries and distributions. Ultimately, the decision should consider factors such as the gym’s ownership structure, financial goals, and long-term plans.

What type of business model is a gym?

A gym typically operates under a business model that combines membership fees, personal training services, and additional gym revenue streams such as retail sales, group classes, or specialized programs. The specific gym business model can vary depending on factors such as the gym’s target market, location, size, and services offered. Some gyms may focus primarily on membership fees, while others may generate significant revenue from personal training or specialized fitness programs. The key is to create a sustainable business model that meets the needs of the target audience and provides a range of services to generate revenue.

What type of legal structure is a gym?

Gyms can adopt various legal structures depending on the ownership and management preferences of the business owners. Common legal structures for gyms include Limited Liability Company (LLC), S Corporation (S Corp), C Corporation (C Corp), or Sole Proprietorship. Each legal structure has its own implications in terms of liability protection, taxation, and management requirements. The choice of legal structure should be made after considering factors such as ownership structure, personal liability protection, tax implications, and long-term business goals.

What is the management structure of a gym?

The management structure of a gym can vary depending on the size and complexity of the operation. In smaller gyms, the owner or a small management team may handle day-to-day operations, including membership management, staff supervision, and financial oversight. In larger gyms, there may be a more hierarchical structure with department managers overseeing different areas such as operations, sales and marketing, fitness programming, and administration. The specific management structure can also be influenced by the gym’s ownership model, such as a single owner, partnership, or franchise.

Are gym franchises or independent gyms typically structured differently (LLC, S Corp, etc)?

The legal structure of a gym, whether it is a franchise or an independent gym, can vary. Gym franchises typically have standardized operating procedures and may require franchisees to adopt a specific legal structure, such as an LLC or corporation, to align with the franchise’s requirements. Independent gyms have more flexibility in choosing their legal structure based on the owners’ preferences and circumstances. Whether a gym is a franchise or independent, it’s important to consult with legal and financial professionals to determine the most suitable legal structure for the specific situation.

Who regulates gyms in the US?

Gyms in the US are primarily regulated at the state and local levels. State health departments, licensing boards, and local municipal authorities may have specific regulations and requirements related to gym operations, safety, cleanliness, and compliance with health codes. Additionally, professional fitness organizations such as the International Health, Racquet & Sportsclub Association (IHRSA) and the National Strength and Conditioning Association (NSCA) provide industry guidelines and best practices for gym operators. It’s important for gym owners to be familiar with and comply with the relevant regulations and guidelines to ensure the safety and well-being of their members and employees.

What business structure is most common for a gym?

The most common business structure for a gym is a Limited Liability Company (LLC). This structure provides personal liability protection and has potential tax benefits. However, the choice can vary based on individual business needs.

What is the best type of business for a gym?

The best type of business for a gym often depends on factors like ownership, size, and financial goals. An LLC is typically preferred for its liability protection and flexibility, but sole proprietorships or partnerships might be suitable for smaller gym operations.

Should I make my gym an LLC?

Making your gym an LLC is generally advisable as it offers personal liability protection, which can be crucial in a business involving physical activity. It also provides flexibility in management and potential tax advantages.

How much does it cost to create an LLC for a gym?

The cost to create an LLC for a gym varies by state but generally ranges from $50 to $500. This cost includes filing fees for the Articles of Organization and any additional state-specific fees.

Do I need a lawyer to create a business entity for my gym?

While it’s not mandatory to have a lawyer to create a business entity, consulting with one can be beneficial for navigating legal requirements and ensuring that all aspects of the business formation are handled correctly.

What are the most important gym legal requirements?

The most important legal requirements for a gym include obtaining a business license, adhering to zoning laws, ensuring compliance with health and safety regulations, and meeting insurance requirements.

Read More: Gym Legal Requirements

Do gyms need insurance?

Yes, gyms need insurance to protect against liabilities such as injuries, accidents, or equipment damage. Common types of insurance for gyms include general liability, professional liability, and property insurance.

Read More: Do gyms need insurance?

What is the business model for a gym?

The business model for a gym typically involves generating revenue through membership fees, personal training services, group classes, and possibly additional services like merchandise sales, nutrition consulting, or spa amenities.

Read More: Gym Business Models

Is a gym a high margin business?

A gym can be a high margin business, especially if it successfully attracts and retains members, offers diverse revenue streams, and efficiently manages operational costs. However, profitability can vary widely based on location, size, and business model.

Read More: How profitable is owning a gym?

How much do gym owners make?

Gym owners make money primarily through membership fees, personal training services, group fitness classes, and ancillary services like merchandise sales, food and beverage offerings, or specialty class fees.

Read More: How much do gym owners make?

Where do gyms make the most money?

Gyms make the most money from membership dues and personal training services. Additional significant revenue streams can include group fitness classes, special programs, and ancillary services like childcare, supplements, or apparel sales.

Read More: How do gyms make money?

Which gyms make the most money?

Larger gym chains or franchises often make the most money due to their scale, brand recognition, and diverse offerings. However, boutique gyms with a unique focus or high-end services can also be highly profitable.

Read More: Most Profitable Fitness Business Models

What are the disadvantages of a gym business?

Disadvantages of a gym business include high initial investment and operational costs, competition in the fitness industry, the need for ongoing equipment maintenance, and reliance on consistent member retention.

Read More: Pros and Cons of Owning a Gym

What are the disadvantages of being a gym owner?

Being a gym owner can be challenging due to responsibilities like managing a large number of clients and staff, maintaining high-quality facilities, adapting to industry trends, and ensuring consistent revenue generation.

Read More: Things to Know Before You Open a Gym

How to set up a gym business?

To set up a gym business, conduct market research, choose a suitable location, develop a business plan, secure financing, obtain necessary licenses and permits, purchase equipment, hire qualified staff, and implement a marketing strategy to attract members.

What type of business is a gym considered, and is a gym a service business?

Gyms are generally considered service businesses as they provide fitness services to their members. They fall under the health and wellness sector and focus on offering various fitness-related services, such as personal training, group classes, and access to workout equipment.

What kind of business structure is best for a gym, and why choose an LLC for a gym?

An LLC, or Limited Liability Company, is often the best business structure for a gym. This is due to the liability protection it offers, safeguarding personal assets against business debts and lawsuits. Additionally, an LLC provides tax benefits and operational flexibility, making it a suitable choice for both small and large gyms.

Are gyms considered retail businesses, and what implications does this have for gym business licenses?

Gyms are not typically considered retail businesses since they primarily provide services rather than sell goods. However, if a gym sells fitness-related products, it might have some retail aspects. So, is a is a gym considered retail? Is a gym a retail business? What kind of business is a gym considered? Understanding if a gym is what type of business is key when starting a gym. This distinction is important when acquiring a gym business license, as the requirements might vary based on the nature of the business – service, retail, or a combination of both.

What should be included in a gym business plan?

A comprehensive gym business plan should include:

- Market analysis and target demographics

- Details of services offered (personal training, classes, etc.)

- Marketing and sales strategies

- Financial projections and funding requirements

- Operational plan, including staff management and gym layout

Incorporating a robust gym software like Exercise.com in your business plan can streamline operations, improve client engagement, and offer valuable data analytics for informed decision-making.

Read More: How to Create a Gym Business Plan

How can a gym structure its business to maximize efficiency and member satisfaction?

To maximize efficiency and member satisfaction, a gym can:

- Adopt a client-centric approach, personalizing services to member needs.

- Utilize efficient gym management software like Exercise.com for booking, billing, and client communication.

- Implement effective staff training programs focused on customer service.

- Regularly update equipment and services based on member feedback and industry trends.

There are many different successful gym business models that you can implement with your gym.

How can Exercise.com help me run my gym professionally?

Exercise.com can help you run your gym professionally by offering comprehensive software solutions for membership management, scheduling, workout programming, progress tracking, and billing. Its platform streamlines operations, enhances member engagement, and offers robust tools for managing and growing your gym business effectively.