How to Choose a Fitness Business Payment Processor

Learn how to choose the best fitness business payment processor. Choosing a online payment processor for your fitness business is crucial, because having a reliable payment processor is a must-have for any fitness business—after all, that’s how you get paid! Whether you run a gym, a yoga studio, or an online fitness platform, having a seamless and secure fitness payment processing system is essential for the success of your business.

But with so many options available, how do you choose the right payment processor for your fitness business? In this article, we will discuss the factors you need to consider and the steps you should take to make an informed decision. Read on to learn how to choose the best payment processor for a fitness business. Then as you learn how to open a gym or how to start a fitness business, be sure to sure to check out the best gym management business software, the best gym payments software, and the best personal training business management software: Exercise.com.

Understanding the Importance of a Reliable Payment Processor for Your Fitness Business

A reliable fitness business payment processor is the backbone of your fitness business, and one of the most important choices when starting a fitness business. It’s the system that allows you to accept payments from your customers, whether it’s for membership fees, class packages, or personal training sessions. Without a reliable payment processor that specializes in gyms and fitness businesses, your business would struggle to accept payments, resulting in a loss of revenue and a poor customer experience.

But it’s not just about accepting payments. A reliable payment processor also ensures that transactions are processed securely and efficiently, protecting both your business and your customers’ sensitive financial information. It can also provide you with valuable insights into your business’s financial performance, helping you make informed decisions and streamline your operations.

In addition, a reliable payment processor can offer various payment options to your customers, making it convenient for them to pay for your services. Whether it’s accepting credit cards, debit cards, or mobile payments, a versatile payment processor allows your customers to choose the method that works best for them. This flexibility can attract more customers and increase customer satisfaction, ultimately benefiting your fitness business.

Read More:

Factors to Consider When Choosing a Payment Processor for Your Fitness Business

When choosing a payment processor for your fitness business, there are several factors you need to consider:

1. Integration with Your Fitness Software or Applications

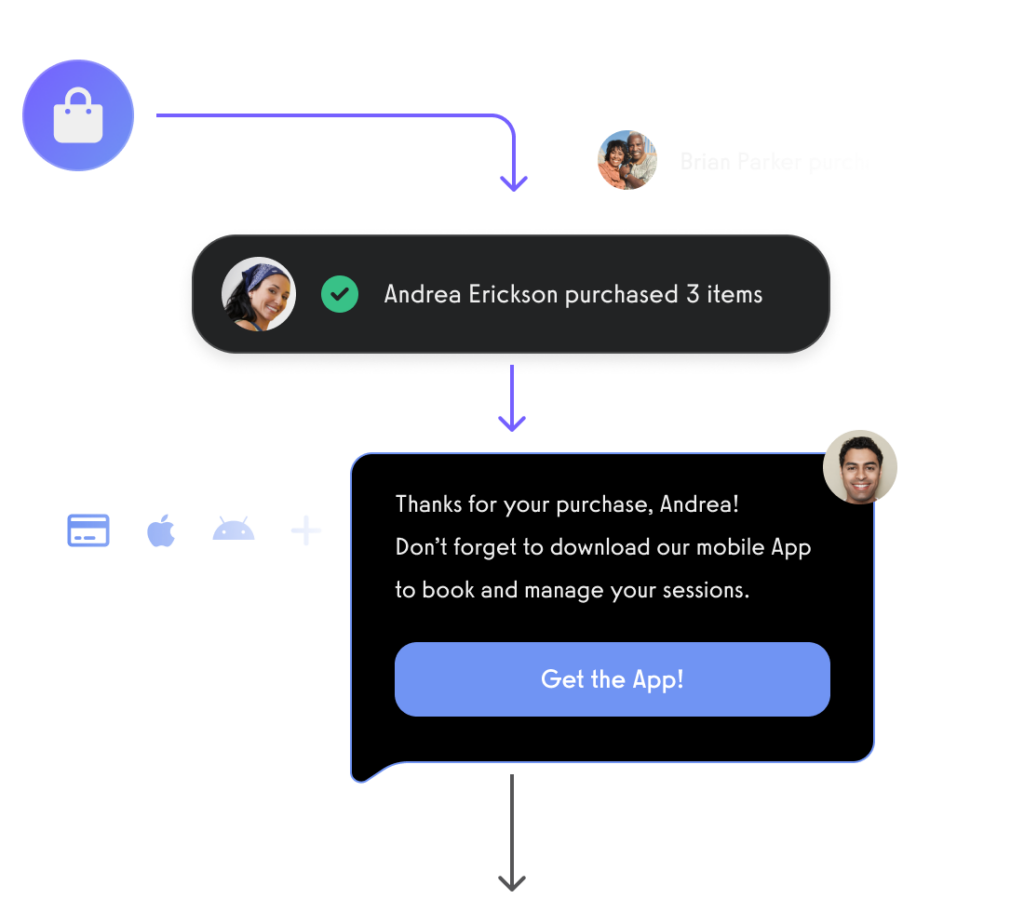

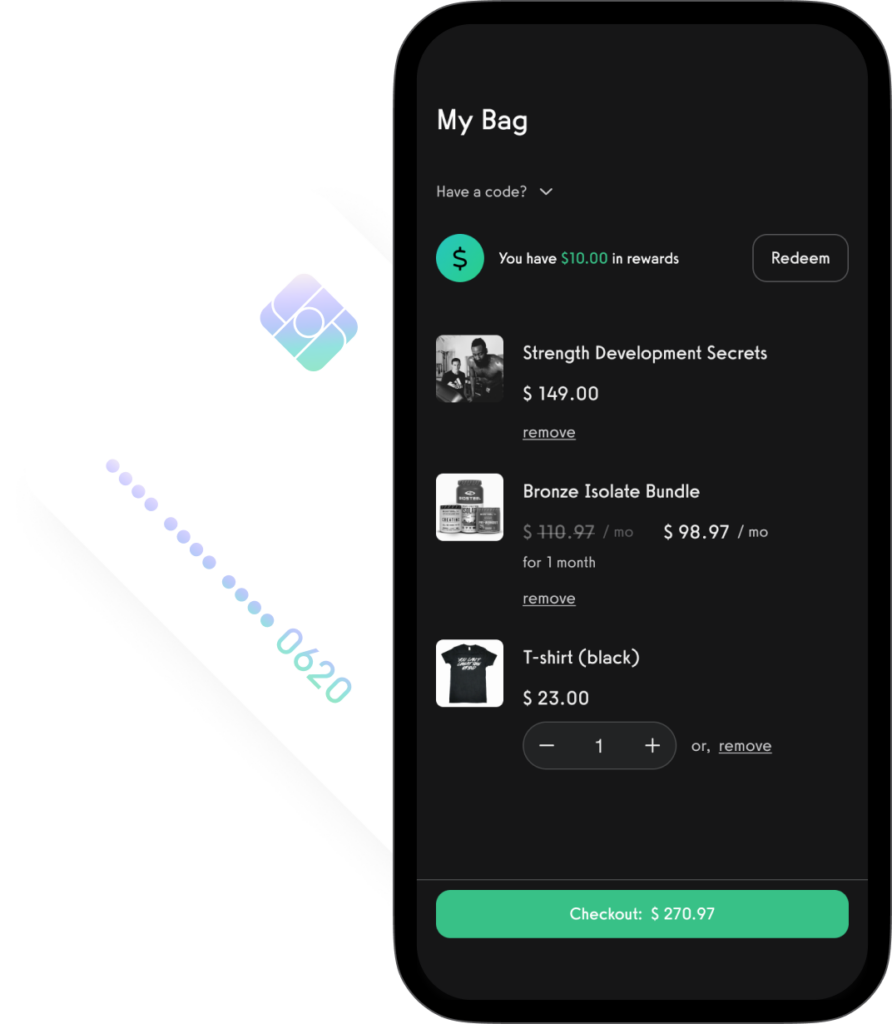

It’s important to choose the best gym payment processor that seamlessly integrates with your preferred fitness software or applications. This integration allows for smooth and efficient payment processing, reducing the chances of errors and providing a seamless experience for your customers. With the Exercise.com platform, you have the best gym payment processing software integrated with the best gym management software so that you can do easy booking, scheduling, client management, online training, and more right in the platform seamlessly and easily.

2. Security Features

Security should be a top priority when choosing a payment processor. Look for processors that offer advanced security features such as encryption, tokenization, and fraud detection tools. These features will help ensure that your customers’ data is protected and reduce the risk of unauthorized transactions.

3. Cost

Consider the cost structure of different payment processors. Look for processors that offer transparent pricing with no hidden fees. Evaluate the transaction fees, monthly fees, and any additional costs associated with the processor. Make sure the benefits you receive justify the costs.

4. Customer Support and Service Levels

Check the reputation of the payment processor when it comes to customer support. Look for processors that offer 24/7 support and multiple channels of communication. This will ensure that you have assistance whenever you need it and can quickly resolve any issues that may arise.

5. Additional Services

Some payment processors offer additional services such as membership management or reporting tools. Consider whether these additional services align with your business needs and can help streamline your operations.

Read More: Best Gym Ecommerce Software

6. Legal and Regulatory Compliance

Ensure that the payment processor you choose complies with all relevant legal and regulatory requirements. This will ensure that your business remains in good standing and that your customers’ data is handled securely and in accordance with applicable laws.

7. Payment Processing Speed

Consider the speed at which the payment processor can process transactions. Look for processors that offer fast processing times to ensure that your customers’ payments are processed quickly and efficiently. This can help improve customer satisfaction and reduce the risk of payment delays.

Read More: How to Have a Fast Gym Check-In Experience

8. International Payment Support

If your fitness business operates globally or plans to expand internationally, it’s important to choose a payment processor that supports international payments. Look for processors that accept multiple currencies and offer international payment options to cater to your diverse customer base.

Assessing Your Fitness Business Payment Processing Needs

Before you start evaluating different payment processors, it’s important to assess your fitness business’s specific payment processing needs. Consider the types of payments you will be accepting, the volume of transactions, and any unique requirements you may have. This assessment will help you determine which features and capabilities are essential for your business.

Additionally, you should also take into account the security measures provided by the payment processors. Look for processors that offer encryption and tokenization to protect sensitive customer data. It’s crucial to prioritize the security of your customers’ payment information to build trust and maintain a good reputation for your fitness business. Read more about the Exercise.com Security best practices.

Evaluating the Security Features Offered by Fitness Business Payment Processors

Security is of utmost importance when it comes to payment processing. Look for payment processors that go beyond the basic security requirements. Encryption, tokenization, and fraud detection tools can provide an added layer of protection for your business and your customers’ financial information. Additionally, consider processors that are PCI-DSS compliant, ensuring that they meet industry standards for data security.

Comparing Different Payment Processing Options for Your Fitness Business

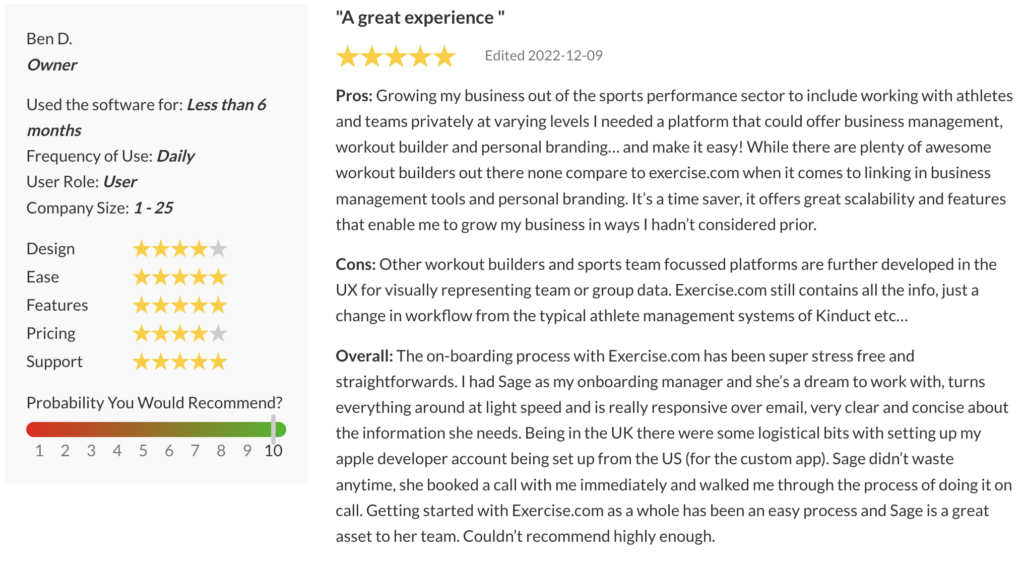

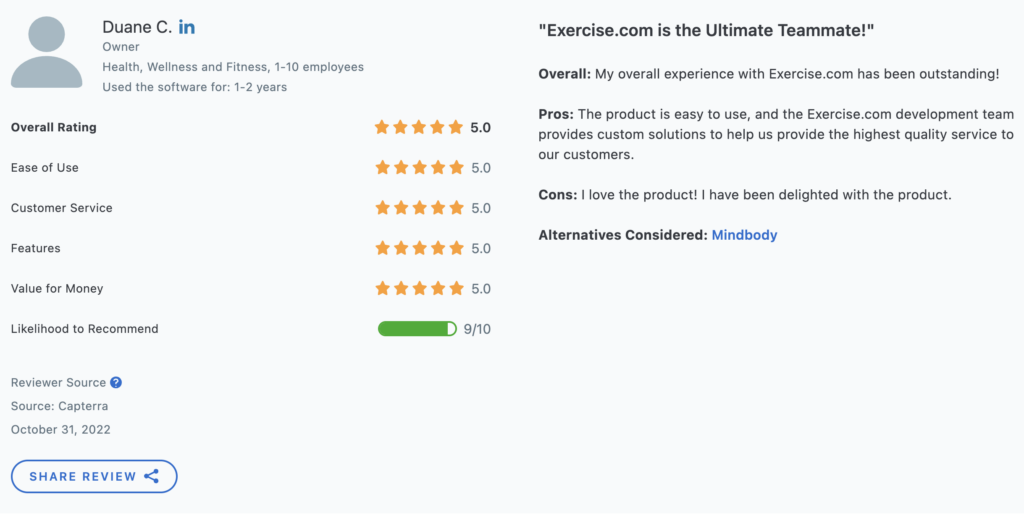

Once you have a clear understanding of your payment processing needs and the security features you require, it’s time to compare different payment processing options. Consider the pros and cons of each option, making sure to evaluate their features, pricing, and reputation. Take into account their track record in the fitness industry, as well as any success stories or testimonials from other fitness businesses.

Key Features to Look for in a Fitness Business Payment Processor

When evaluating payment processors, certain key features can make a significant difference in the success and efficiency of your fitness business:

1. Payment Gateway

A robust payment gateway that offers seamless integration with your fitness software or applications is essential. This allows for smooth payment processing and reduces the risk of transaction errors.

2. Recurring Billing

If you offer membership or subscription-based services, look for a payment processor that supports recurring billing. This feature automates the payment process, ensuring a steady revenue stream for your business.

3. Mobile Payments

In today’s mobile-centric world, it’s essential to offer mobile payment options. Look for payment processors that support mobile payments, allowing your customers to easily make payments using their smartphones or tablets.

4. Reporting and Analytics

Insights into your business’s financial performance are invaluable. Look for payment processors that offer robust reporting and analytics tools, allowing you to track revenue, sales trends, and customer behavior.

Read More:

5. Integration with Accounting Software

Streamline your financial operations by choosing a payment processor that integrates with popular accounting software. This integration eliminates the need for manual data entry, reducing errors and saving you time on reconciling your financial records.

Read More: Best Gym Software with QuickBooks Integration

The Pros and Cons of Using Third-Party Payment Processors for your Fitness Business

Third-party payment processors, such as PayPal or Stripe, can offer convenience and ease of use. They provide ready-to-use payment solutions that require minimal setup and technical know-how. However, there are also some downsides to consider. Third-party processors may charge higher transaction fees compared to dedicated fitness payment processors, and they may not offer the same level of customization and integration options.

Understanding the Costs Associated with Different Fitness Business Payment Processing Solutions

When evaluating payment processors, it’s crucial to consider the costs associated with their services. Transaction fees, monthly fees, setup fees, and additional costs for add-on features can all add up. Calculate the potential costs based on your business’s transaction volume and choose a payment processor that offers a fair pricing structure and aligns with your budget.

Tips for Negotiating Better Rates with a Fitness Business Payment Processor

Don’t be afraid to negotiate with payment processors to get the best possible rates. Consider factors like transaction volume, average ticket size, and the length of the contract when negotiating. Explore the possibilities of lower rates, reduced fees, or waived charges. Remember, payment processors want your business, so they may be willing to negotiate to win you over as a customer.

The Importance of Seamless Integration between Your Fitness Business and the Payment Processor

Seamless integration between your fitness business and the payment processor is crucial for a smooth customer experience. Choose a payment processor that offers easy integration with your website or fitness software. This integration will enable you to offer a seamless payment process, from browsing your services to completing a transaction, enhancing customer satisfaction and loyalty.

Ensuring Compatibility: Choosing a Payment Processor that Supports Your Preferred Fitness Software or Applications

Before finalizing your decision, ensure that the payment processor you choose supports your preferred fitness software or applications. Confirm that they have the necessary integration capabilities and have successfully integrated with similar platforms. This compatibility will ensure a seamless flow of data and information, reducing the chances of technical issues or interruptions.

Exploring Additional Services Provided by Fitness Business Payment Processors, such as Membership Management or Reporting Tools

Some payment processors offer additional services that can benefit your fitness business. Membership management tools, for instance, can help you track member attendance, manage renewals, and handle other administrative tasks. Reporting tools can provide you with valuable insights into your business’s financial performance. Consider whether these additional services align with your business needs and can help streamline your operations.

How to Set Up and Configure your Chosen Payment Processor for your Fitness Business

Once you have chosen a payment processor, it’s time to set up and configure it for your fitness business. Follow the instructions provided by the processor, which typically involve creating an account, integrating it with your website or software, and configuring your preferred payment options. Test the payment process thoroughly to ensure it works seamlessly before launching it to your customers.

Ensuring Compliance: Understanding the Legal and Regulatory Requirements of a Fitness Business Payment Processor

Compliance with legal and regulatory requirements is essential for any fitness business payment processor. Ensure that the processor you choose complies with all relevant laws and regulations, such as the Payment Card Industry Data Security Standard (PCI-DSS). This compliance will provide peace of mind knowing that your transactions and customers’ data are handled securely and in accordance with industry best practices.

Assessing Customer Support and Service Levels Offered by Potential Fitness Business Payment Processors

Customer support and service levels are critical when it comes to payment processors. Look for processors that offer 24/7 support and multiple channels of communication, such as phone, email, and live chat. Research the processor’s reputation when it comes to customer support, and consider reaching out to their existing customers for feedback. A responsive and knowledgeable support team will ensure that you have the assistance you need when you need it.

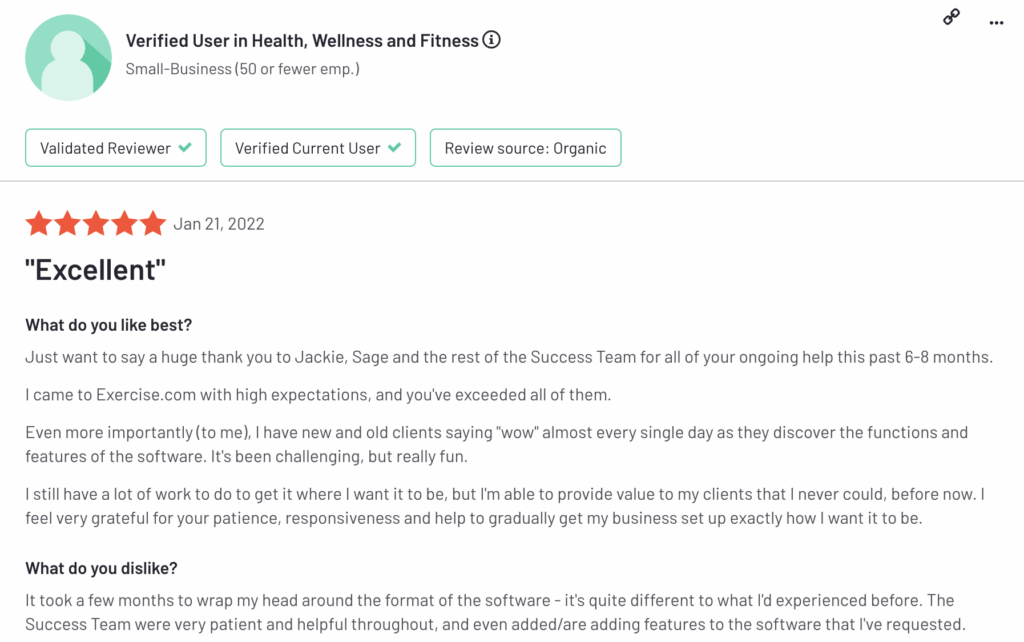

Case Studies: Success Stories and Testimonials from Other Fitness Businesses Regarding their Choice of Payment Processor

Which fitness payment processing system is best and why?

The best fitness payment processing system is one that offers convenience, security, and integration with your existing systems. Exercise.com’s fitness business management software stands out in this regard. It offers a fully integrated payment processing system that allows businesses to collect one-time payments, set up recurring memberships, sell packages, and even automate payment plans. It is PCI compliant, ensuring a high level of security for your clients’ financial data. Additionally, the software integrates payment processing with other aspects of business management, such as booking and scheduling, member management, and reporting.

How do I choose a payment system for my fitness business?

Choosing a payment system for your fitness business involves considering several factors. First, it should be secure and reliable to protect your customers’ financial information. It should also offer flexibility in terms of the types of payments it can handle, such as one-time payments, recurring memberships, and payment plans. Ease of use, both for you and your clients, is another important consideration. It’s beneficial if the system integrates seamlessly with your other business operations, such as scheduling and member management. Exercise.com is a great choice in this regard, offering a secure, versatile, and integrated payment processing solution.

Why should I use Exercise.com as the payment processor for my fitness business?

Exercise.com offers an efficient and secure payment processing system tailored to the needs of fitness businesses. By using Exercise.com, you can streamline the payment process, accepting both one-time and recurring payments with ease. The system is designed to be user-friendly, making it simple for your clients to make payments. Plus, it’s PCI-compliant, ensuring that all transactions are secure and that client data is protected. Finally, Exercise.com’s payment processing is integrated within a comprehensive fitness business management software, meaning you can manage bookings, member interactions, and payments all in one place. This level of integration makes managing your fitness business simpler and more efficient.

Common Mistakes to Avoid when Selecting a Payment Processor for your Fitness Business

Choosing the wrong payment processor can have serious consequences for your fitness business. Avoid these common gym owner mistakes:

1. Not Assessing Your Business’s Specific Needs

Each fitness business has unique payment processing requirements. Assess your business needs thoroughly before making a decision.

2. Focusing Solely on Cost

While cost is important, it shouldn’t be the sole determining factor. Consider the overall value and benefits you will get from the payment processor.

3. Neglecting Security and Compliance

Security and compliance should be top priorities. Choose a payment processor that prioritizes data security and complies with relevant regulations.

4. Overlooking Integration with Your Software or Applications

Ensure that the payment processor integrates seamlessly with your existing software or applications. This integration will save you time and reduce the chances of technical issues.

5. Not Researching Customer Support and Service Levels

Customer support is crucial in case any issues or questions arise. Choose a payment processor with a reputation for excellent customer support.

By considering these factors and avoiding common mistakes, you can choose the right payment processor for your fitness business. Remember, a reliable payment processor is the foundation of your business’s financial success and customer satisfaction. Take the time to research and evaluate your options to make an informed decision that will benefit your business in the long run.