How do you value a gym business? (4 Ways)

Learn how to value a gym business so both gym buyers and gym sellers can understand the gym business valuation process, the different ways to value a gym, and how to increase gym valuation.

The gym valuation guide below explores four primary methods for valuing a gym business: Earnings Multiple, Comparable Sales, Discounted Cash Flow, and Asset-Based Valuation. Each gym valuation method offers a unique approach, considering factors like earnings, market comparisons, future cash flows, and tangible assets to determine a gym’s worth.

| Valuation Method | Description | Key Metrics Used | Pros | Cons | When to Use |

|---|---|---|---|---|---|

| Income Approach | Focuses on the gym’s ability to generate future revenue and profit, typically using a discounted cash flow (DCF) analysis or multiple of EBITDA. | Revenue, profit, cash flow, and discount rates. | Captures the gym’s true earning potential. Ideal for gyms with stable, predictable cash flow. | Requires accurate financial projections. Can be complex to calculate. | Best for established gyms with consistent revenue and profitability trends. |

| Market Approach | Compares the gym to other similar businesses in the market that have been recently sold or are listed for sale. | Market trends, sale prices, and industry multiples. | Easy to understand and apply. Reflects real-world market conditions. | Dependent on the availability of comparable sales data. May not account for unique gym-specific factors. | Ideal when there is ample market data for similar gyms. |

| Asset-Based Approach | Values the business based on the total value of its tangible and intangible assets minus liabilities. | Book value of assets, equipment depreciation, and liabilities. | Useful for gyms with substantial tangible assets. Simple to calculate. | Does not reflect the gym’s earning potential. May undervalue businesses with strong brand equity or loyal membership. | Best for asset-heavy gyms or those with minimal profitability. |

| Comparable Sales Approach | Looks at the sale price of comparable gyms and adjusts for differences in size, location, and amenities. | Sales data, gym size, location, and amenities. | Provides a realistic valuation based on actual transactions. Simple and transparent for buyers and sellers. | Limited by the availability of recent, comparable sales data. Adjustments can introduce subjectivity. | Best when selling or buying a gym and recent comparable sales are available. |

If you’re wondering how do you value a gym business, then read this gym valuation guide to understand the key things to know. Valuing a gym business is sometimes more art than science, but there are key quantitative factors you need to know. It’s important to know the value of a gym before buying a gym, selling a gym, opening a gym, or making any major decisions based on a gym valuation.

Learn all about buying an existing gym business, learn how to sell a gym business and know what do gyms sell for exactly anyway (be ready for the lawyer answer, “it depends”…), find out what you need to know to plug in key gym KPI metrics in to a gym valuation calculator, get a firm handle on average gym profit margins and how your gym business stacks up, and more.

Then be sure to take a look through our gym owner guide and then request a demo to see if we can help you with the best gym business management software, the best personal training business management software, and the best all around fitness business management software in order to professionalize your gym business and run a successful gym business that will increase gym revenue and profit, and ultimately increase your gym’s valuation.

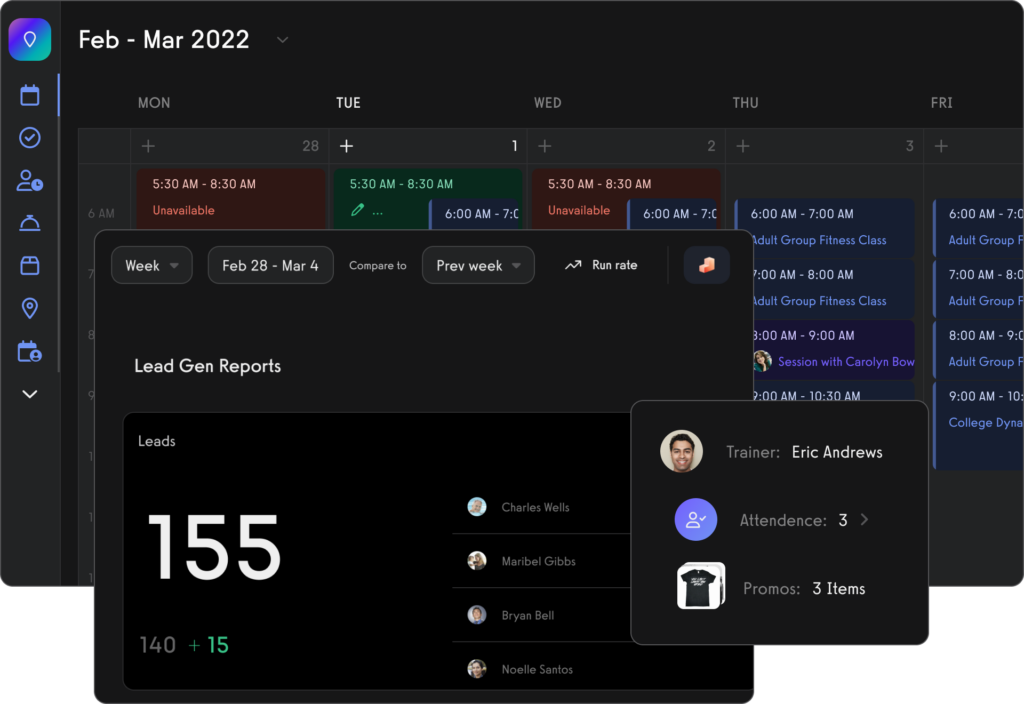

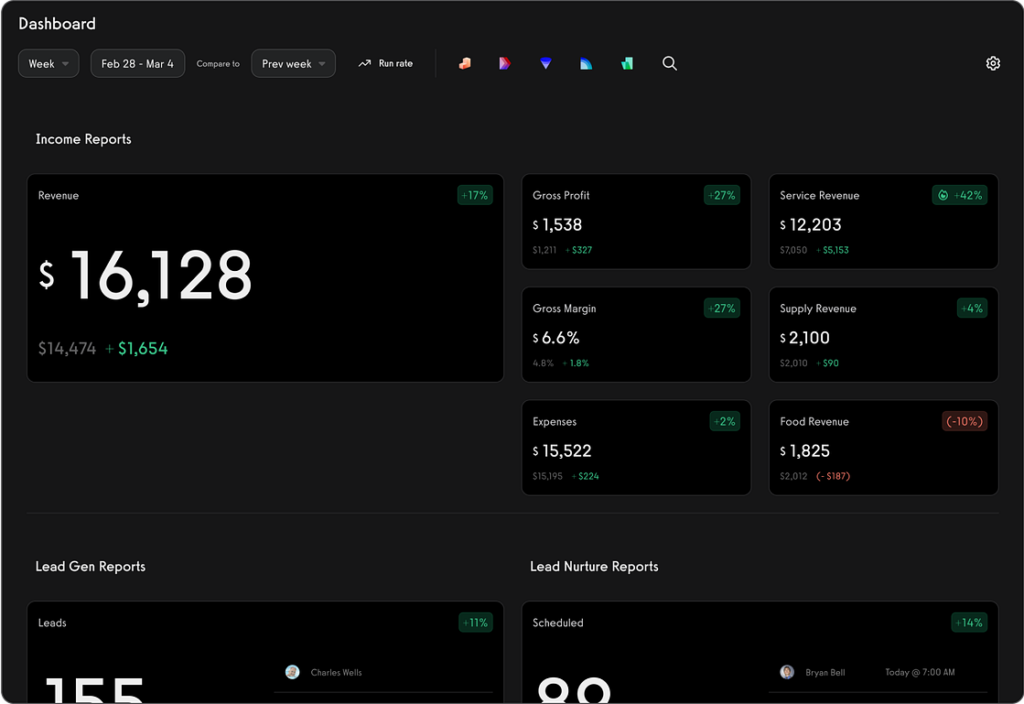

Use a robust gym reporting suite to truly understand your gym’s key metrics that will impact your gym’s valuation.

And as our reviews from gym owners attest, see why our gym software has gym owners raving (get a free demo here).

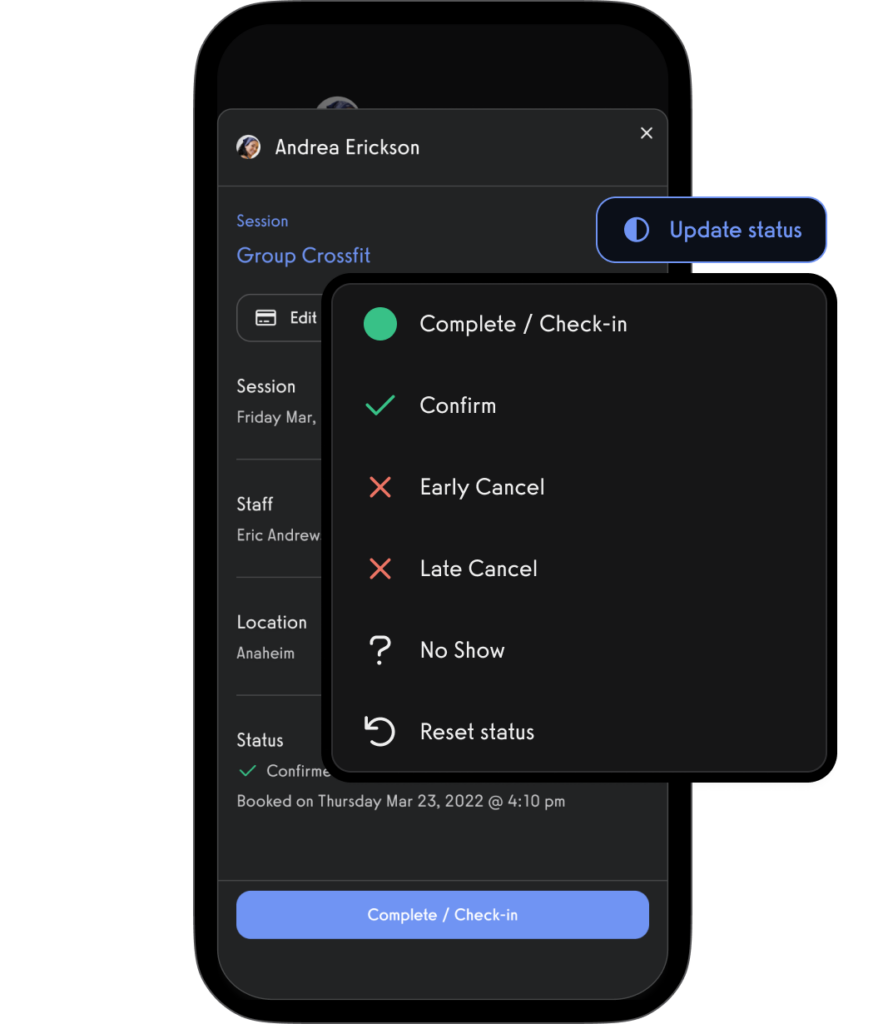

Gym check-in software that makes your life easy. (Read More: Best Gym Check-In Software)

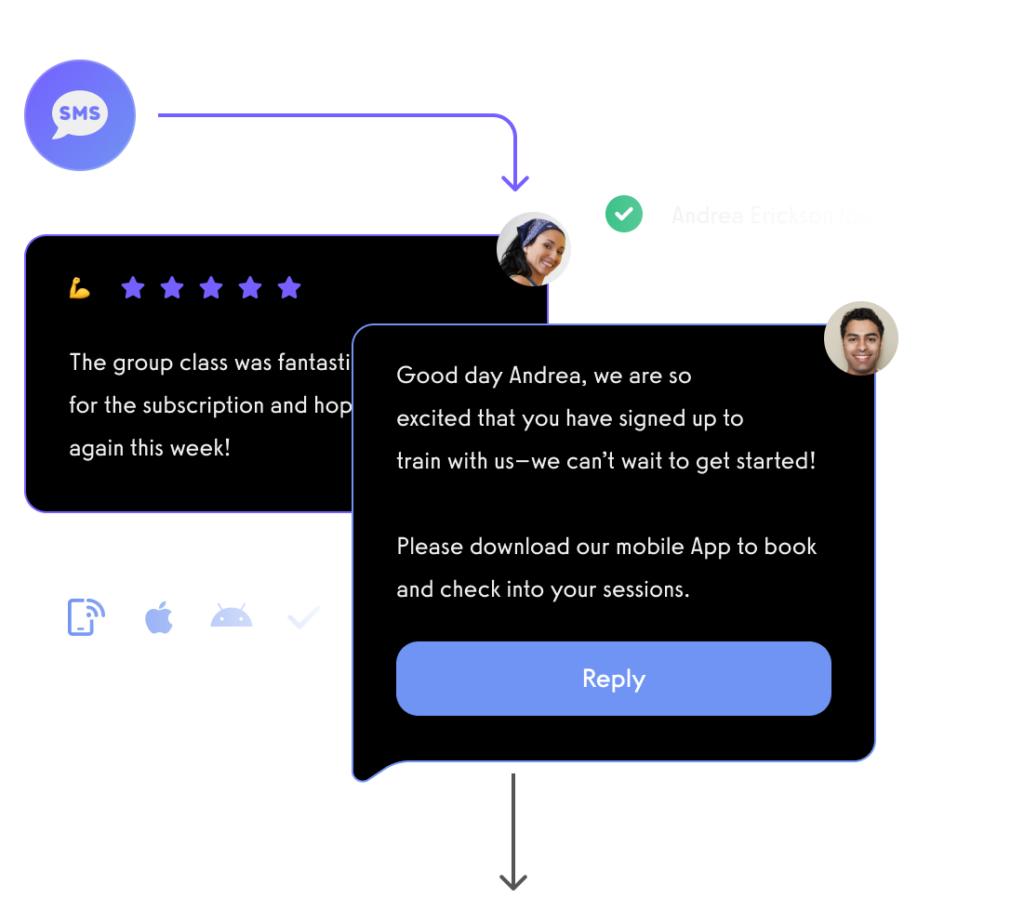

Communicate with gym members, athletes, team members, personal training clients, class members, parents, and dependents via SMS, email, and in-app push notification.

And of course, view all of your gym business reports to get the gym financial data you need for a gym valuation easily too.

All from your custom-branded fitness apps (Read More: Best Gym Mobile Fitness Apps Software)

#1 Gym Earnings Multiple Valuation

By far the most common method for establishing a gym valuation, the earnings multiple method is a simple way to value a gym business. It involves taking the business’s earnings (usually EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) or SDE (Seller’s Discretionary Earnings)) and multiplying it by a multiple that’s specific to the fitness industry.

For gym businesses, the gym business valuation multiple typically ranges from 3 to 5 but can be as low as 1 for very small gyms and can be even higher than 5 for large gyms with many other favorable factors. This method is quick and easy, but it doesn’t take into account the specific characteristics of the gym business.

| EBITDA | Selling Price |

| 0 – $50,000 | 1.0-1.5 times EBITDA |

| $50,000 – $150,000 | 1.5-2.0 times EBITDA |

| $150,000 – $250,000 | 2.0-2.5 times EBITDA |

| $250,000 – $500,000 | 2.5-3.0 times EBITDA |

| $500,000 – $1,000,000 | 3.0-3.5 times EBITDA |

| $1,000,000 and up | 3.5-5.0 times EBITDA |

Gym Earnings Multiple Valuation Example

The gym earnings multiple valuation method is a widely used approach to estimate the value of a gym business. Here’s an example of how to value a gym using this method:

Example Data:

- Earnings (EBITDA): $150,000

- Industry Multiple Range: 3 to 5

Valuation Calculation Steps:

- Determine the Earnings: Start with the gym’s EBITDA, which, in this example, is $150,000.

- Select an Appropriate Multiple: Choose a multiple within the industry range. Factors influencing the choice include the gym’s size, location, and growth potential. For this example, let’s use a multiple of 4.

- Calculate the Valuation: Multiply the earnings by the selected multiple. So, $150,000 (Earnings) × 4 (Multiple) = $600,000.

Valuation Result:

- Estimated Gym Value: $600,000

Table of Data:

| Earnings (EBITDA) | Selected Multiple | Estimated Gym Value |

|---|---|---|

| $150,000 | 4 | $600,000 |

Key Things to Know

- The gym earnings multiple method is quick and straightforward.

- It requires an accurate understanding of the gym’s earnings and an appropriate selection of the multiple.

Pros

- Simplicity: Easy to understand and apply.

- Speed: Quick way to estimate value, useful for initial assessments or negotiations.

- Industry Relevance: Reflects industry standards and expectations.

Cons

- Lack of Specificity: Does not account for unique aspects of the gym, like location or special services.

- Earnings Fluctuation: Valuation is sensitive to changes in earnings, which can be affected by factors outside the gym’s control.

This method provides a general valuation but should be supplemented with other methods for a more comprehensive understanding of a gym’s value.

Gym Earnings Multiple Valuation: Application for Buyers and Sellers

For Sellers: Selling a Gym Business or Selling a Fitness Business

- Understand Your Earnings: Familiarize yourself with your gym’s financials, especially the EBITDA. This understanding is crucial for setting a realistic and attractive selling price.

- Choose the Right Multiple: Select a multiple that reflects your gym’s market position, size, and growth potential. For instance, a well-established gym with a strong membership base might warrant a higher multiple.

- Highlight Strengths: If your gym has unique strengths (like specialized programs or a prime location), make these a selling point to justify a higher multiple.

- Professional Valuation: Consider using gym valuation services or consulting with gym business brokers to ensure an accurate and fair valuation.

For Buyers: Buying a Gym Tips or Where to Buy a Gym

- Verify Financials: Thoroughly examine the gym’s financial statements and EBITDA calculations. Ensure that the earnings are consistent and sustainable.

- Assess the Multiple: Analyze whether the multiple used is appropriate for the gym’s market and condition. Comparing with other gym businesses for sale can provide context.

- Negotiation: Use the earnings multiple valuation as a starting point for price negotiations. Be prepared to discuss why you might value the gym differently.

- Future Potential: Consider the gym’s potential for growth or expansion, and how that might affect its future earnings, which could influence your valuation.

Additional Considerations

- Gym EBITDA Multiple: Understanding and negotiating the EBITDA multiple is a critical component of this method. A gym’s historical financial performance and market trends play a significant role in determining this multiple.

- Market Trends: Stay informed about the latest fitness industry trends. Factors like emerging fitness technologies or shifts in consumer preferences can impact a gym’s future earnings potential.

- Complementary Valuation Methods: While the earnings multiple method provides a quick estimate of a gym’s value, it’s often beneficial to complement this approach with other valuation methods, such as asset-based valuation or discounted cash flow analysis, for a more rounded understanding.

The Gym Earnings Multiple Valuation method is a practical and widely-used approach for both buyers and sellers in the gym business market. It offers a straightforward way to estimate the value of a gym based on its earnings, but it’s important to consider this method in the context of the gym’s unique features, market position, and future potential for a comprehensive valuation.

Read More:

- How to Create a Gym Budget

- Gym Sales Forecasting Guide

- Accounting for Gyms

- Best Gym Accounting Software

How to Calculate Gym EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)

To calculate your gym’s earnings before interest, taxes, depreciation, and amortization (EBITDA), start with the profit shown on your Profit & Loss statement, then add back interest, taxes, depreciation, and amortization. EBITDA is the starting point for any business valuation (not just gyms), and is quite common in the private equity world, so it’s a good number to track on an annual basis. Read more about gym average profitability.)

Source: Sports Club Advisors

How to Calculate Gym SDE (Seller’s Discretionary Earnings)

An alternate gym valuation method that is quite similar to the EBITDA valuation method is the SDE Method. This could really be it’s own valuation methodology but is included with the EBITDA valuation methodology because it is essentially the same thing but for smaller gym businesses run by owner operators.

Start with the gym’s pre-tax earnings from the income statement and then:

| Operation | Variables |

| Add | Non-operating expenses |

| Subtract | Non-operating income |

| Add | One-time expense |

| Subtract | Non-recurring income |

| Add | Amortization expenses and depreciation |

| Add | Interest expense |

| Subtract | Interest income |

| Add | One owner’s total salary |

| Adjust | Compensation of other stakeholders to market value |

Source: Two Brain Business

#2 Gym Comparable Sales Valuation

The comparable sales method involves looking at similar gyms that have been sold recently and using those sales as a benchmark for valuing your gym business. This method can provide a more accurate valuation, but it’s important to find comparable businesses that are truly similar to yours.

Factors to consider when looking for comparable businesses include location, size, and type of gym. Most of this is self-evident. A CrossFit gym valuation is different from a Yoga Studio valuation is different form a sports performance gym valuation; and a Nashville, TN gym valuation is different from a Miami, FL gym valuation is different from a Houston, TX gym valuation.

The Comparable Sales method is a key approach in understanding how to value a gym business. This method is particularly useful for those considering selling a gym business or buying a gym, as it provides real-world sale prices as benchmarks.

Gym Comparable Sales Valuation Example

- Identify Comparable Sales: Find recent sales of similar gyms in your area. For example, if you’re valuing a CrossFit gym, look for sales of similar CrossFit gyms.

- Adjust for Differences: Adjust the valuation based on differences between your gym and the comparables. This could involve size, location, membership base, or equipment quality.

- Calculate Average Sale Price: From the adjusted values of the comparable sales, calculate an average or median price. This serves as a benchmark for your gym’s value.

Factors to Consider in Comparable Sales

- Location: A gym for sale in a high-traffic urban area may have a different value compared to one in a suburban or rural setting.

- Type of Gym: Different gym types (e.g., traditional gyms, CrossFit boxes, boutique studios) will have different valuations.

- Size and Membership Base: Larger gyms or those with a substantial membership base may have higher valuations.

Pros

- Market-Relevant: Provides a value based on actual market transactions.

- Contextual Accuracy: Offers insight into what buyers are willing to pay for similar businesses.

Cons

- Availability of Data: It can be challenging to find recent and relevant sales data, especially for unique gym types.

- Subjective Adjustments: Determining adjustments for differences between gyms can be subjective and may require professional appraisal services.

Application for Buyers and Sellers

For Sellers (Selling a Gym Business/Selling a Fitness Business)

- Utilize gym business brokers who may have access to recent sales data.

- Consider gym appraisal services for a more accurate comparison.

- Use the comparable sales data to set a competitive and realistic asking price.

For Buyers (Buying a Gym Tips/Where to Buy a Gym)

- Use gym valuation services to ensure you are paying a fair price.

- Analyze different ways to value a gym business to make an informed decision.

- Consider the potential of the gym (e.g., “how to price used gym equipment” or “how to sell a gym”) to assess its future growth potential.

Additional Considerations

- Gym Valuation Calculator: While a gym valuation calculator might provide a quick estimate, the comparable sales method offers a more tailored approach, considering specific market conditions.

- Gym EBITDA Multiple: Understanding the gym’s EBITDA multiple in the context of comparable sales can offer additional insight into its financial health.

- Market Trends: Stay informed about the latest trends in the fitness industry, as this can affect gym valuations and sale prices.

The gym Comparable Sales Valuation method offers a practical approach to determine a gym’s market value, based on actual sales data of similar businesses. This method is beneficial for both buyers and sellers, providing a realistic view of what the market dictates for a gym’s worth.

#3 Gym Discounted Cash Flow Valuation

The discounted cash flow method involves projecting the future cash flows of the business and discounting them back to present value. This method takes into account the specific characteristics of the business and can provide a more accurate valuation. However, it’s also the most time-consuming and requires the most information about the business.

The Discounted Cash Flow (DCF) method is a more detailed and finance-focused approach to determine how to value a gym business. This method is especially relevant when selling a gym business or considering buying a gym, as it accounts for the future profitability of the business.

Steps to Calculate Gym Discounted Cash Flow Valuation

- Forecast Cash Flows: Estimate the gym’s future cash flows for a certain period, usually 5 to 10 years. This involves detailed financial planning, including projected revenues and expenses.

- Determine Discount Rate: The discount rate reflects the risk and the time value of money. This could be based on the gym’s weighted average cost of capital (WACC) or an appropriate rate for the fitness industry.

- Calculate Present Value: Discount the future cash flows back to their present value using the discount rate. This calculation gives you the current value of the gym’s expected future earnings.

Gym Cash Flow Calculation Example

- Projected Cash Flows for 5 Years: $120,000; $130,000; $140,000; $150,000; $160,000

- Discount Rate: 8%

- Present Value of Each Year’s Cash Flow: Calculated using the formula PV = FV / (1 + r)^n, where PV is Present Value, FV is Future Value, r is the discount rate, and n is the year number.

Pros

- Future-Oriented: Provides a view of the gym’s potential future profitability.

- Specific to Your Business: Tailored to the specific financial forecasts and circumstances of your gym.

Cons

- Complexity: Requires detailed financial knowledge and assumptions, making it more complex than other methods.

- Sensitive to Assumptions: The accuracy of the valuation heavily depends on the accuracy of the cash flow projections and the chosen discount rate.

Application for Buyers and Sellers

For Sellers (Selling a Gym Business/Selling a Fitness Business)

- Develop detailed and realistic financial projections to showcase your gym’s potential.

- Consider employing professional gym valuation services to accurately perform a DCF analysis.

For Buyers (Buying a Gym Tips/Where to Buy a Gym)

- Use the DCF method to evaluate the long-term value and return on investment of a potential gym purchase.

- Be cautious with the assumptions used in the forecast and consider getting a second opinion from financial experts or gym business brokers.

Additional Considerations

- Business Valuation of a Gym Calculator: While a basic calculator may not be suitable for a full DCF analysis, specialized financial software or tools can assist in performing these calculations.

- Gym EBITDA Multiple: Understanding the gym’s EBITDA can aid in projecting future cash flows accurately.

- Market Trends and Risks: Consider current market trends and potential risks in the fitness industry that might impact future cash flows.

The Discounted Cash Flow method provides a comprehensive way to value a gym by considering its future financial potential. Although it requires more financial acumen and detailed forecasting, this method can offer a thorough perspective for both buyers and sellers on the long-term value of the gym business.

#4 Gym Asset-Based Valuation

The gym asset-based valuation method involves valuing the gym business based on the value of its assets, such as equipment and real estate. This method is typically used for businesses that have a significant amount of tangible assets. It’s important to note that this method doesn’t take into account the business’s earning potential, so it may not provide an accurate valuation for a gym business.

The Asset-Based Valuation method is an approach focused on the tangible and intangible assets of a gym business. This method is particularly relevant for determining how to value a gym that has significant physical assets or for those considering selling a gym business with considerable equipment or property value.

Steps in a Gym Asset-Based Valuation

- List All Assets: Compile a comprehensive list of the gym’s assets, including gym equipment, real estate, and any other tangible assets. Also, consider intangible assets like brand value and memberships.

- Assign a Value to Each Asset: Determine the current market value of each asset. For tangible assets like gym equipment, this might involve how to price used gym equipment. For intangible assets, this could be more complex.

- Calculate Total Asset Value: Add up the values of all assets to get the total asset value of the gym.

Gym Asset-Based Valuation Calculation Example

- Gym Equipment: $200,000

- Real Estate (if owned): $500,000

- Brand Value: $50,000

- Total Asset Value: $750,000

Pros

- Simplicity: Easier to calculate as it involves tangible assets.

- Clarity: Provides a clear picture of the gym’s physical value.

Cons

- Doesn’t Reflect Earning Potential: This method overlooks the gym’s potential profitability and cash flow.

- Asset Depreciation: The value of assets like gym equipment can depreciate over time.

Application for Buyers and Sellers

For Sellers (Selling a Gym Business/Selling a Fitness Business)

- Ensure all assets are well-maintained to maximize their value.

- Consider using gym appraisal services to accurately value assets, especially for high-value items like real estate.

For Buyers (Buying a Gym Tips/Where to Buy a Gym)

- Use this method as part of a broader valuation strategy, especially if the gym has significant physical assets.

- Consider the cost of replacing or upgrading assets as part of the investment decision.

Additional Considerations:

- Gym Valuation Services: Professional valuation services can provide a more accurate assessment of both tangible and intangible assets.

- Gym Business for Sale/Gym for Sale: For a gym business for sale, this method can provide a baseline for the physical value of the business.

- Different Ways to Value a Gym Business: The asset-based valuation should be used in conjunction with other valuation methods to get a comprehensive understanding of the gym’s worth.

The Asset-Based Valuation method offers a straightforward approach to valuing a gym based on its physical and tangible assets. While this method provides clarity on the gym’s material worth, it is essential to combine it with other valuation methods to get a complete picture of the gym’s overall value, especially when considering its future earning potential and market positioning.

Key Factors that Impact Gym Valuation

When considering how to value a gym business, whether you’re buying or selling, it’s crucial to understand the various factors that contribute to how much a gym is worth. Using methods like the Gym Earnings Multiple Valuation can provide a foundational estimate, but this should be part of a broader analysis.

For Sellers: Selling a Gym Business

- Understand Your Gym’s Value: Utilize methods like the Gym Earnings Multiple Valuation and consult gym valuation services or gym appraisal services to get a comprehensive view of your gym’s value. The gym EBITDA multiple, usually ranging from 3 to 5, is a critical factor in determining your gym’s market value.

- Prepare Your Business for Sale: Ensure your financial records are in order, and consider how to price used gym equipment. Improving aspects of your business that can increase its valuation, such as upgrading equipment or enhancing member services, can be beneficial.

- Marketing Your Gym: When selling a gym business, particularly niche gyms like a CrossFit gym, it’s essential to target the right audience. Gym business brokers can assist in reaching potential buyers effectively.

- Setting the Right Price: Use a business valuation of a gym calculator as a starting point for setting a price but also consider market conditions and unique aspects of your gym, like location and member loyalty.

For Buyers: Buying a Gym Business

- Due Diligence: Thoroughly research the gym business for sale. Look into its financial health, membership trends, and market position. Buying a gym tips include assessing local competition and understanding the gym’s current market share.

- Valuation Tools: A gym valuation calculator can be a useful tool, but it should not be the only method used. Consider different ways to value a gym business, including its cash flow, assets, and potential for growth.

- Negotiating the Purchase: When negotiating, consider not just how much is a gym worth based on its current earnings, but also its potential for growth and any investments required for improvements.

- Location and Market Trends: The value of a gym can vary significantly based on its location. A gym for sale in a high-demand area may command a higher price than one in a less populated area.

- Seek Professional Advice: Engaging gym valuation services or consulting with gym business brokers can provide insights and guidance, especially for first-time buyers.

Additional Considerations for Both Parties

- Market Trends: The fitness industry is dynamic, and understanding current trends is crucial. For instance, the demand for boutique fitness experiences versus traditional gym setups can influence a gym’s value.

- Selling a Fitness Business Online: In today’s digital age, having an online presence can add value to your business. This could include virtual training options, a strong social media presence, or an interactive website.

- Exit Strategy for Sellers: If you’re looking to sell my gym, it’s important to have a clear exit strategy that maximizes the sale’s profitability while ensuring a smooth transition for the new owners and existing members.

- Location Opportunities for Buyers: If you’re wondering where to buy a gym, consider areas with growing populations or underserved markets for fitness services.

In summary, valuing a gym business requires a multifaceted approach, whether you’re selling or buying. Utilizing various valuation methods, understanding the market, and preparing effectively for sale or purchase are key steps in achieving a successful transaction

Gym Valuation Tips

- Understand the method you’re using to value your business. Each gym valuation method has its own strengths and weaknesses, and it’s important to choose the one that’s most appropriate for your business. Ultimately, it’s important to keep in mind that a gym is only worth what someone will pay!

- Be honest with yourself about your gym’s strengths and weaknesses. This will help you to make more accurate projections and find comparable businesses.

- Get professional help if you need it. A business broker or a financial advisor can help you to value your business more accurately and provide guidance on the selling process. Some business brokers even specialize in the fitness industry. (Read more here: How to Buy a Gym Business & How to Find Gyms for Sale)

Understanding Gym Valuation Multiples

Valuing a gym business involves understanding various metrics, market conditions, and the type of gym being evaluated. Gym valuation multiples are one of the most common tools used to determine a gym’s worth, often based on metrics such as revenue, EBITDA (earnings before interest, taxes, depreciation, and amortization), or membership base. These multiples vary depending on the type of gym, whether it’s a traditional gym, boutique fitness studio, or CrossFit gym for sale. For example, CrossFit valuation often factors in community loyalty and branding, which can differ significantly from other gym business models.

For gym owners preparing for a gym business sale or those interested in buying a CrossFit gym, it’s essential to evaluate both tangible and intangible assets. Tangible assets include equipment, lease agreements, and the physical location, while intangible assets may include brand equity, membership contracts, and goodwill. Liquidation scenarios may involve selling off liquidation gym equipment, often for less than its original value. On the other hand, those looking to buy may wonder, how much does it cost to buy a gym or specifically, how much does it cost to buy a CrossFit gym. The answer varies widely based on location, size, and amenities, but typical purchase costs can range from $50,000 to several hundred thousand dollars.

For fitness professionals exploring gym ownership, it’s crucial to assess operational and financial aspects. Start by analyzing the average cost to open a gym, which depends on whether the facility is boutique, general fitness, or niche-focused like a basketball gym for sale. Additionally, understanding how to evaluate gym business metrics—such as revenue per member, retention rates, and profit margins—is key when assessing any fitness business for sale or fitness club for sale. Gym buyers and sellers must also consider gym business capital, including startup costs, operational cash flow, and future growth needs. For aspiring owners, researching how to get a loan for a gym can help secure the funding needed to make the investment.

If you’re preparing to sell, it’s important to present your gym as an attractive opportunity to gym investors. A well-prepared fitness appraisal and a clear understanding of the gym’s unique value can help secure a favorable price. Whether you’re selling a CrossFit gym or buying one, ensuring you’re equipped with accurate financial and operational data will make the process smoother. Aspiring buyers often ask, how much is it to buy a gym or how much to buy a gym, and the answer depends on the type of gym and its valuation. Whether you’re exploring fitness businesses for sale or considering a fitness club for sale, proper planning and research will help you navigate the process confidently.

How to Increase Gym Valuation

To increase gym valuation, focus on boosting profitability and enhancing the gym’s attractiveness to potential buyers. This can be achieved by increasing membership numbers through effective marketing, diversifying revenue streams (like personal training, group classes, and selling merchandise), and improving operational efficiency to reduce costs. Additionally, investing in modern equipment and maintaining the facility can significantly enhance the gym’s appeal, thereby increasing its valuation.

If you want to buy a gym or sell a gym, it’s essential that you understand how gym valuation works. The Earnings Multiple Method, Comparable Sales Method, Discounted Cash Flow Method, and Asset-Based Method are all methods that can be used to value a gym business.

It’s important to understand the method you’re using and be honest with yourself about your gym’s strengths and weaknesses. If you need help buying or selling a gym, don’t hesitate to seek professional assistance from a business broker or a financial advisor.

And if you need help managing and growing your gym business, get a demo today.

What factors should I consider when valuing a gym business?

When valuing a gym business, consider the following factors:

- Revenue: Analyze your gym’s historical and projected revenue to determine its financial performance.

- Profitability: Assess your gym’s profit margins and overall profitability, taking into account operating costs, overhead, and other expenses.

- Membership base: Consider the size and growth of your gym’s membership base, as well as member retention and churn rates.

- Location: Evaluate the desirability and accessibility of your gym’s location, along with local competition and market saturation.

- Assets: Inventory your gym’s assets, such as equipment, real estate, and intellectual property, and consider their value.

- Brand and reputation: Assess the strength of your gym’s brand and its reputation within the community and industry.

- Growth potential: Consider the potential for future growth and expansion, including market trends and opportunities.

How do you value a gym company?

Valuing a gym company typically involves several methods, with the Earnings Multiple Method being the most common. This approach calculates the gym’s value by multiplying its earnings before interest, taxes, depreciation, and amortization (EBITDA) by an industry-specific multiple, usually ranging from 3 to 5. To accurately value a gym, you must first determine its EBITDA, then apply an appropriate multiple based on factors like location, size, membership base, and growth potential.

So, how do you calculate the value of a gym? To calculate gym value with a quick rule of thumb, be sure to include the following key considerations:

- Gym History

- Predictability of Revenue

- Recurring vs One-Time Revenue

- Location

- Online vs In-Person

- Niche

- Trends (Macro and Industry)

- Size

- Equipment

- Staff

For fitness professionals looking to value their gym business efficiently, Exercise.com provides robust management software that can streamline financial tracking and analysis, making the valuation process more straightforward and accurate. With its comprehensive tools, Exercise.com helps gym owners understand their financial standing better, aiding in a more accurate valuation of their business.

What are the most common methods for valuing a gym business?

There are several common methods for valuing a gym business, including:

- EBITDA valuation: Calculates the value of a gym based on a multiple of it’s profit (EBITDA, or SDE).

- Asset-based valuation: Calculates the value of the gym based on the total value of its tangible and intangible assets, minus any liabilities.

- Income-based valuation: Estimates the gym’s value based on its ability to generate future income, typically using discounted cash flow or capitalization of earnings methods.

- Market-based valuation: Compares the gym to similar businesses that have recently been sold in the market to determine its relative value.

How can I determine the value of my gym’s assets?

To determine the value of your gym’s assets, you can:

- Create an inventory of all tangible assets, such as gym equipment, furniture, and real estate. You may need to obtain appraisals or valuations for high-value items.

- Calculate the value of intangible assets, such as intellectual property (trademarks, copyrights), client lists, and goodwill. This may require the assistance of a professional valuator.

- Deduct any outstanding liabilities, such as gym loans or gym lease obligations, from the total asset value to determine the net asset value of your gym.

What multiples do gyms sell for?

Gyms typically sell for multiples ranging from 3 to 5 times their annual earnings before interest, taxes, depreciation, and amortization (EBITDA). This range can vary based on several factors such as the gym’s location, size, clientele, and market trends. High-performing gyms in prime locations with a strong and loyal membership base may command higher multiples. For fitness professionals using Exercise.com, the software’s comprehensive reporting and business management tools can provide valuable insights into the gym’s financial health, aiding in determining an appropriate multiple for sale.

How much can you sell a gym for?

The selling price of a gym is contingent upon various factors, including its earnings, market position, membership base, and location. A gym’s sale price is often calculated by applying a multiple, typically between 3 to 5, to its annual earnings (EBITDA). Therefore, a gym with an EBITDA of $200,000 might sell for between $600,000 to $1,000,000. Utilizing Exercise.com’s gym management software, owners can efficiently track and optimize their business operations and financials, potentially increasing the gym’s value and selling price.

What do gyms sell for when they are not very profitable?

When gyms are not very profitable, they tend to sell for lower multiples, often closer to the 1 to 3 range of their EBITDA. The sale price in such cases may also heavily factor in the gym’s assets, location, and potential for growth or turnaround. For struggling gyms, implementing a robust management system like Exercise.com can help streamline operations, enhance member experiences, and potentially increase profitability, thereby improving the gym’s selling price.

How can I increase gym profit?

To increase gym profit, focus on enhancing membership retention, diversifying revenue streams, and optimizing operational efficiency. Implementing targeted marketing strategies to attract new members and engaging current members through personalized programs can boost profitability. Additionally, offering ancillary services like personal training, nutrition counseling, or merchandise sales can create additional income sources. Exercise.com’s comprehensive software aids in efficiently managing these aspects, from marketing to member management, making it an invaluable tool for increasing gym profits.

Read More: How to Increase Gym Revenue and Profit

What is the valuation method for a gym that is most commonly used?

The most commonly used valuation method for a gym is the Earnings Multiple Method. This approach involves multiplying the gym’s EBITDA by an industry-specific multiple, generally ranging from 3 to 5. This method is favored for its simplicity and effectiveness in providing a quick estimate of the gym’s value based on its current financial performance. For gym owners, using Exercise.com’s software to accurately track and manage financial data can aid in applying this valuation method effectively.

What is a good profit margin for a gym?

A good profit margin for a gym typically ranges between 10% to 20%. However, this can vary based on the gym’s business model, location, size, and management efficiency. High-end or specialty gyms might achieve higher margins, while community-focused gyms might operate at lower margins. Tools provided by Exercise.com can help gym owners optimize their operations and manage expenses efficiently, potentially improving their profit margins.

Read More: Average Gym Profit Margin

What is the average profit from owning a gym?

The average profit from owning a gym can vary significantly based on the gym’s size, location, and business model. Small to mid-sized gyms might see annual profits ranging from $20,000 to $100,000, while larger or more successful gyms could realize profits in the higher six-figure range. Utilizing management software like Exercise.com helps in maximizing revenue streams and minimizing operational costs, potentially increasing the average profit.

Read More: Average Gym Profit Margin

What is the average revenue of a gym owner?

The average revenue of a gym owner depends on the size and type of gym. Small, independently-owned gyms may generate annual revenues of about $100,000 to $300,000, while larger gyms or those in more affluent areas can see revenues upwards of $500,000 to several million dollars. Revenue is influenced by factors like membership fees, the range of services offered, and the effectiveness of the gym’s management practices. Exercise.com’s management software assists gym owners in optimizing revenue streams, from membership management to ancillary service offerings, enhancing the potential for higher revenue generation.

Read More: How much money can you make as a gym owner?

Where do gyms make the most money?

Gyms make the most money from membership fees, which typically constitute the core revenue stream. Additionally, substantial income is generated through personal training services, group classes, and ancillary services like nutrition programs, childcare, and merchandise sales. High-profit gyms often excel in member retention and engagement, maximizing the lifetime value of each member. Exercise.com’s software supports these efforts by providing tools for membership management, targeted marketing, and service diversification, all contributing to increased revenue.

Read More: Ways Gyms Make Money

How many members does a gym need to be profitable?

The number of members a gym needs to be profitable varies depending on the gym’s size, overhead costs, membership fees, and additional revenue sources. Generally, small to medium-sized gyms may need between 300 to 500 active members to be profitable, considering average membership fees and operating costs. Utilizing a platform like Exercise.com helps optimize member retention and acquisition strategies, making it easier for gym owners to reach and maintain profitable membership levels.

Read More: How many members does an average gym have?

How do gyms make so much money?

Gyms make money primarily through membership fees, which provide a consistent revenue stream. Additionally, they profit from personal training sessions, group fitness classes, and ancillary services such as wellness programs, merchandise sales, and special events. Successful gyms maximize their earnings by focusing on member retention, diversifying income sources, and optimizing operational efficiency. Exercise.com’s gym management software aids in these areas by streamlining operations, enhancing member engagement, and providing tools for additional revenue generation.

Read More: Ways Gyms Make Money

How to calculate a gym valuation quickly and easily?

To calculate a gym valuation quickly and easily, the most straightforward method is the Earnings Multiple Method. This involves multiplying the gym’s annual earnings (EBITDA) by an industry-specific multiple, typically between 3 to 5. For a more detailed valuation, considering factors like membership trends, location, and market competition is essential. Exercise.com’s software can provide the necessary financial and operational data, making the valuation process more efficient and accurate.

What is the best formula for a gym valuation?

The best formula for a gym valuation is often the Earnings Multiple Method, which multiplies the gym’s annual earnings (EBITDA) by a standard industry multiple. This method balances simplicity with accuracy, providing a reasonable estimate of the gym’s market value. For a more comprehensive valuation, combining this method with other approaches like asset-based valuation or discounted cash flow analysis can be beneficial. Exercise.com’s management software provides valuable data that can inform these valuation formulas, ensuring a well-rounded assessment of the gym’s worth.

What is a common EBITDA multiple for a gym business?

A common EBITDA multiple for a gym business typically ranges from 3 to 5. This multiple can vary based on factors such as the gym’s location, membership stability, brand reputation, and growth potential. Gyms with strong market positions and growth prospects may command higher multiples. Accurate financial tracking and analysis using tools like those provided by Exercise.com can help determine the most appropriate EBITDA multiple for a specific gym business.

What multiple do gyms sell at when they are very profitable vs not so profitable?

When gyms are very profitable, they tend to sell at higher multiples, often between 4 to 5 or more. In contrast, less profitable gyms may sell at lower multiples, typically ranging from 1 to 3. The profitability, along with factors like market position, brand strength, and growth potential, influences the chosen multiple. Efficient management and optimization of a gym’s operations and finances, as facilitated by Exercise.com, can positively impact its profitability and, consequently, the selling multiple.

What are things to sell at a gym that can increase gym valuation?

Selling additional services and products at a gym can significantly increase its valuation. This includes personal training sessions, group fitness classes, nutrition counseling, wellness programs, and merchandise like fitness apparel and equipment. Offering unique or specialized services, like massage therapy or physical therapy, can also add value. Exercise.com’s software supports these ventures by facilitating service management, scheduling, and sales tracking, ultimately enhancing the gym’s overall valuation.

Read More:

- How to Create Multiple Gym Revenue Streams

- How to Sell Supplements in a Gym

- Gym Business Secrets for Growth

- How to Sell Fitness Online

How do you calculate gym revenue?

To calculate gym revenue, sum up all income streams including membership fees, personal training charges, class fees, and sales from ancillary services and products. This total represents the gross revenue. Exercise.com’s management software can streamline this process by tracking all revenue sources in one platform, providing an accurate and easily accessible overview of the gym’s financial performance.

How do you calculate gym profit?

Gym profit is calculated by subtracting total expenses from total revenue. Expenses include staff salaries, utility bills, equipment maintenance, marketing costs, and any other operational costs. The remainder is the net profit. Utilizing Exercise.com’s software helps gym owners effectively track both revenue and expenses, simplifying the calculation of gym profit and aiding in financial decision-making.

How much is the gym market worth?

The global gym market was valued at approximately $100 billion, with projections for continued growth. This valuation is driven by increasing health awareness, the popularity of fitness activities, and technological advancements in fitness equipment and management software. Exercise.com, being at the forefront of this technological advancement, plays a significant role in enhancing gym operations and member experiences, contributing to the overall growth and value of the gym market.

How do you calculate gym value on a new gym?

Calculating the value of a new gym involves estimating its potential earnings and growth prospects. For a new gym, use projected earnings, considering factors like expected membership numbers, pricing strategy, and anticipated operational costs. An industry-standard multiple, typically between 3 to 5, can then be applied to these projected earnings. However, because the gym is new and lacks historical financial data, this calculation may require more assumptions and market analysis. Tools like Exercise.com can aid in creating realistic projections based on market data and similar business models.

What is a good profit margin for a gym?

A good profit margin for a gym typically ranges between 10% to 30%. The variation depends on factors such as the gym’s location, size, and business model. High-end or specialized gyms often have higher profit margins due to premium pricing, while community gyms might operate with lower margins due to broader accessibility and lower prices.

Read More: Average Gym Profit Margin

What is the average revenue of a gym owner?

The average revenue of a gym owner varies widely based on the gym’s size, location, and the services offered. Small, independent gyms might see annual revenues from $100,000 to $500,000, while larger facilities or those in high-demand areas could generate revenues in the millions.

What is a good EBITDA in the fitness industry?

A good EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) in the fitness industry typically ranges from 10% to 20% of the gym’s revenue. However, this can vary based on the gym’s operational efficiency, location, and market conditions. A higher EBITDA indicates better financial health and operational efficiency.

What are the assets of a gym?

The assets of a gym include physical items like fitness equipment, furniture, and fixtures, as well as intangible assets such as the gym’s brand, memberships, and intellectual property like training programs or proprietary software. Real estate, if owned by the gym, is also a significant asset.

Is owning a gym a profitable business?

Owning a gym can be a profitable business if managed effectively. Success factors include a strong business plan, effective marketing strategies, a robust membership base, and efficient operational management. However, profitability can vary based on competition, market trends, and the owner’s business acumen.

Read More: Average Gym Profit Margin

Do gym owners make a lot of money?

The amount of money gym owners make can vary significantly. Some gym owners may make a substantial income, especially if they own multiple locations or have a large, loyal membership base. However, income can fluctuate based on factors like location, gym size, and business model.

Read More: How much money can you make as a gym owner?

Is owning a gym passive income?

Owning a gym is not typically considered passive income as it requires active management, especially in areas like staff management, member engagement, and facility maintenance. However, with a strong management team and efficient systems in place, gym ownership can become less hands-on over time.

Read More: What is passive income in fitness?

What is the success rate of opening a gym?

The success rate of opening a gym can be challenging to quantify due to varying definitions of success and the impact of external factors like location and economic conditions. However, with a well-executed business plan, market research, and effective management, many gyms can achieve profitability and long-term success.

Read More: What to Know Before Opening a Gym

How many members does an average gym have?

The number of members an average gym has can vary widely. Small to medium-sized gyms might have 300 to 1000 members, while larger facilities or those in densely populated areas could have several thousand members. Membership numbers are influenced by the gym’s size, location, and the type of gym (e.g., boutique studio vs. large fitness center).

Read More: How many members does an average gym have?

How do you do a gym equipment valuation?

To do a gym equipment valuation, assess the current market value of each piece of equipment. This involves considering the equipment’s age, condition, brand, and depreciation. Research similar equipment prices in the market and adjust the valuation based on your equipment’s specific details. For a comprehensive valuation, it may be wise to consult with gym appraisal services. Exercise.com’s software can aid in inventory management and tracking the value of gym assets over time, providing a clearer picture for valuation purposes.

Read More: Gym Equipment Depreciation Guide

What is the depreciation rate for gym equipment?

The depreciation rate for gym equipment typically ranges from 10% to 20% per year. This rate depends on the type of equipment, its usage intensity, and maintenance practices. High-quality equipment that is well-maintained can have a slower depreciation rate.

Read More: Gym Equipment Depreciation Guide

What is the average life of gym equipment?

The average life of gym equipment varies based on the type of equipment and its usage. Cardio machines like treadmills and ellipticals typically last between 7 to 12 years, while strength equipment like weight machines and free weights can last 10 to 20 years or more. Regular maintenance and proper usage can extend the lifespan of gym equipment. The lifespan also depends on the quality of the equipment and the intensity of its use in the gym setting.

Read More: Gym Equipment Depreciation Guide

How can I increase the value of my gym business before selling it?

To increase the value of your gym business before selling it, consider the following strategies:

- Improve profitability: Reduce expenses and increase revenue to boost your gym’s profit margins and overall profitability.

- Enhance membership retention: Implement member retention strategies, such as personalized services and loyalty programs, to reduce churn rates and maintain a stable membership base.

- Upgrade equipment and facilities: Invest in modern, high-quality equipment and maintain a clean, attractive facility to increase the perceived value of your gym.

- Strengthen your brand: Develop a strong brand identity and reputation through effective marketing and excellent customer service.

- Optimize operations: Streamline your gym’s operations and implement efficient management practices to demonstrate its potential for growth and success.

How can I use industry benchmarks and ratios to value my gym business?

Using industry benchmarks and ratios can help you compare your gym’s performance to that of similar businesses within the fitness industry. Common benchmarks and ratios include:

- Revenue per member: Divide your gym’s total revenue by the number of members to calculate revenue per member.

- Membership churn rate: Calculate the percentage of members who cancel their memberships over a given period.

- Operating profit margin: Divide your gym’s operating profit by its total revenue to determine its operating profit margin.

By comparing your gym’s performance to industry averages, you can identify areas of strength and weakness and assess its overall value relative to other businesses.

Should I hire a professional valuator to appraise my gym business?

Hiring a professional valuator can provide several benefits when appraising your gym business, including:

- Expertise: Professional valuators have the knowledge and experience to accurately assess the value of your gym’s tangible and intangible assets.

- Objectivity: An unbiased third-party valuation can lend credibility to your gym’s value, particularly during negotiations with potential buyers.

- Comprehensive analysis: A professional valuator can provide a thorough analysis of your gym’s financial performance, market position, and growth potential.

- Customized approach: A professional valuator can tailor their valuation methodology to your specific gym and the fitness industry, ensuring a more accurate valuation.

While hiring a professional valuator can be an additional expense, the benefits may outweigh the costs, particularly when selling your gym business or seeking financing.

How does the local market and competition impact the value of my gym business?

The local market and competition can significantly impact the value of your gym business in several ways:

- Market saturation: If your gym is located in an area with a high concentration of fitness centers, it may face increased competition, which could negatively impact its value.

- Market demand: The overall demand for fitness services in your area can influence your gym’s revenue potential and growth opportunities. High demand may increase your gym’s value, while low demand may decrease it.

- Local demographics: The demographics of your gym’s target market, such as age, income, and fitness preferences, can impact its ability to attract and retain members.

- Economic conditions: Local economic factors, such as employment rates and disposable income, can affect consumers’ willingness and ability to spend on fitness services, which may influence your gym’s value.

By assessing the local market and competition, you can better understand the factors that may impact your gym’s value and develop strategies to mitigate potential risks or capitalize on opportunities.

What role do industry trends and market conditions play in valuing a gym business?

Industry trends and market conditions can have a significant impact on the valuation of a gym business by affecting its growth potential and future profitability. Some factors to consider include:

- Consumer preferences: Changes in consumer preferences, such as the popularity of boutique fitness studios or virtual workouts, may influence the demand for traditional gym services.

- Technological advancements: Emerging technologies, such as fitness tracking devices and virtual reality workouts, may create new opportunities or challenges for your gym business.

- Regulatory changes: Changes in regulations or licensing requirements may impact your gym’s operations and compliance costs.

- Economic conditions: Broader economic factors, such as recessions or periods of economic growth, can influence consumer spending on fitness services and memberships.

By staying informed of industry trends and market conditions, you can adapt your gym’s business model and strategies to remain competitive and maintain or increase its value.

Read More: Gym Statistics

How much is a multi-location gym worth?

The worth of a multi-location gym depends on its combined revenue, profitability, brand value, and market presence. Valuation can range significantly based on the size and success of the individual locations, member base, and operational efficiency. Multi-location gyms often benefit from economies of scale and brand recognition, potentially increasing their value. Exercise.com’s software is particularly beneficial in managing multi-location gyms, providing centralized control and data analysis for better decision-making and valuation.

Read More:

How much is a CrossFit gym worth?

The worth of a CrossFit gym varies depending on its membership base, location, community engagement, and profitability. Typically, successful CrossFit gyms can be valued at multiples of their EBITDA, similar to traditional gyms, with the multiple depending on the gym’s financial health and market position. Exercise.com’s robust software can enhance the management and growth of a CrossFit gym, potentially increasing its valuation.

How much is a boutique fitness gym worth?

A boutique fitness gym’s worth hinges on unique factors like its specialized offerings, brand reputation, customer loyalty, and location. These gyms often command a premium due to their specialized services and personalization. Their valuation may include a higher EBITDA multiple compared to traditional gyms, reflecting their niche market appeal and potential profitability. Exercise.com’s software supports boutique gyms in optimizing their operations and enhancing member experiences, thereby contributing to a higher valuation.

How much is a yoga studio worth?

The worth of a yoga studio is determined by several factors, including location, client base, revenue, profitability, and brand reputation. Typically, valuation is done using the earnings multiple method, where the studio’s earnings (like EBITDA) are multiplied by a specific industry multiple, which can range based on the studio’s size and market conditions. For a more personalized valuation, factors such as the studio’s unique offerings, membership retention rates, and potential for growth are also considered. Exercise.com’s software can assist in accurately tracking these financial metrics, providing a clearer picture of a yoga studio’s value.

How do I create a gym business plan?

Creating a gym business plan involves outlining your business goals, target market, marketing strategies, financial projections, and operational plans. Start by defining your gym’s unique selling proposition, analyze your target market, and develop a solid marketing strategy. Include detailed financial projections like startup costs, ongoing expenses, and revenue forecasts. Exercise.com can aid in this process by providing tools for market analysis, financial management, and strategic planning, helping to develop a comprehensive and effective business plan for your gym.

Read More:

How do I get a gym loan to buy a gym?

To get a loan to buy a gym, start by preparing a detailed business plan that outlines the gym’s value proposition, financial projections, and growth potential. Ensure your credit history is in good standing, and research various loan options such as small business loans, SBA loans, or loans from private investors. Present a strong case to lenders by demonstrating the gym’s profitability and your plan for its future success. Utilizing tools from Exercise.com can help in creating persuasive financial reports and business plans to present to potential lenders.

Read More: Gym Loan Guide

How do I sell a gym?

To sell a gym, begin by valuing your business accurately, considering factors like earnings, membership numbers, and assets. Prepare all financial documents and ensure the gym is in good physical condition. Market your gym to potential buyers through various channels, including online platforms and gym business brokers. Be prepared to negotiate terms and provide detailed information to interested buyers. Utilizing a platform like Exercise.com can help in organizing and presenting your gym’s operational and financial data effectively to potential buyers.

Read More: How to Sell a Gym

How do I buy a gym?

When buying a gym, conduct thorough due diligence to understand the gym’s financial health, membership base, market position, and potential growth. Assess the location, competition, and existing equipment. Negotiate terms that reflect both the current value and future potential of the gym. Consider consulting with gym business brokers for insights and potential listings. Exercise.com’s software can be valuable for analyzing operational efficiency and potential growth strategies once you acquire the gym.

Read More:

What are some pros and cons of owning a gym?

Pros:

- Personal Fulfillment: Operating a gym can be rewarding, especially if you’re passionate about fitness and helping others achieve their health goals.

- Market Demand: With a growing focus on health and fitness, there’s a steady demand for quality gym services.

- Diverse Revenue Streams: Gyms can generate income from memberships, personal training, classes, and merchandise.

Cons:

- High Initial Investment: Starting a gym can require significant capital for space, equipment, and initial operations.

- Competitive Market: The fitness industry is highly competitive, requiring continuous innovation and marketing efforts to stand out.

- Operational Challenges: Managing a gym involves multiple facets like staff management, equipment maintenance, and member retention, which can be challenging.

Read More: Pros and Cons of Owning a Gym

What are some reasons gyms fail?

Gyms often fail due to a lack of clear business strategy, poor financial management, and inadequate market research. Other reasons include failing to differentiate from competitors, not keeping up with industry trends, poor location, and inadequate member retention strategies. Ineffective marketing and a lack of understanding of the target audience can also lead to failure. It’s crucial for gym owners to continuously evaluate and adapt their business models to meet the changing needs and preferences of their clientele.

Read More: Reasons Gyms Fail

How can Exercise.com help me run a successful and professional gym business?

Exercise.com’s software is designed to help you run a successful and professional gym business by offering comprehensive tools for business management. It assists in creating customizable workout plans, tracking client progress, managing memberships, and handling scheduling and billing efficiently. The platform also offers marketing tools to help you engage with your current members and attract new ones. Additionally, its robust reporting features provide valuable insights into business performance, aiding in making informed decisions for growth and improvement. By leveraging these tools, Exercise.com helps streamline your gym’s operations, enhance client satisfaction, and drive business success.